SituationA fast-growing beverage producer had a long-standing practice of locking in physical prices with its aluminum can suppliers. This form of “physical hedging” left the company subject to supplier credit risk and with an inability to verify if quoted prices were accurate or current. Furthermore, given that the physical hedges were specific to certain can sizes and volumes, they were not portable as demand changed. As a result, the company was often overpaying for the aluminum component of its can contracts. |  |

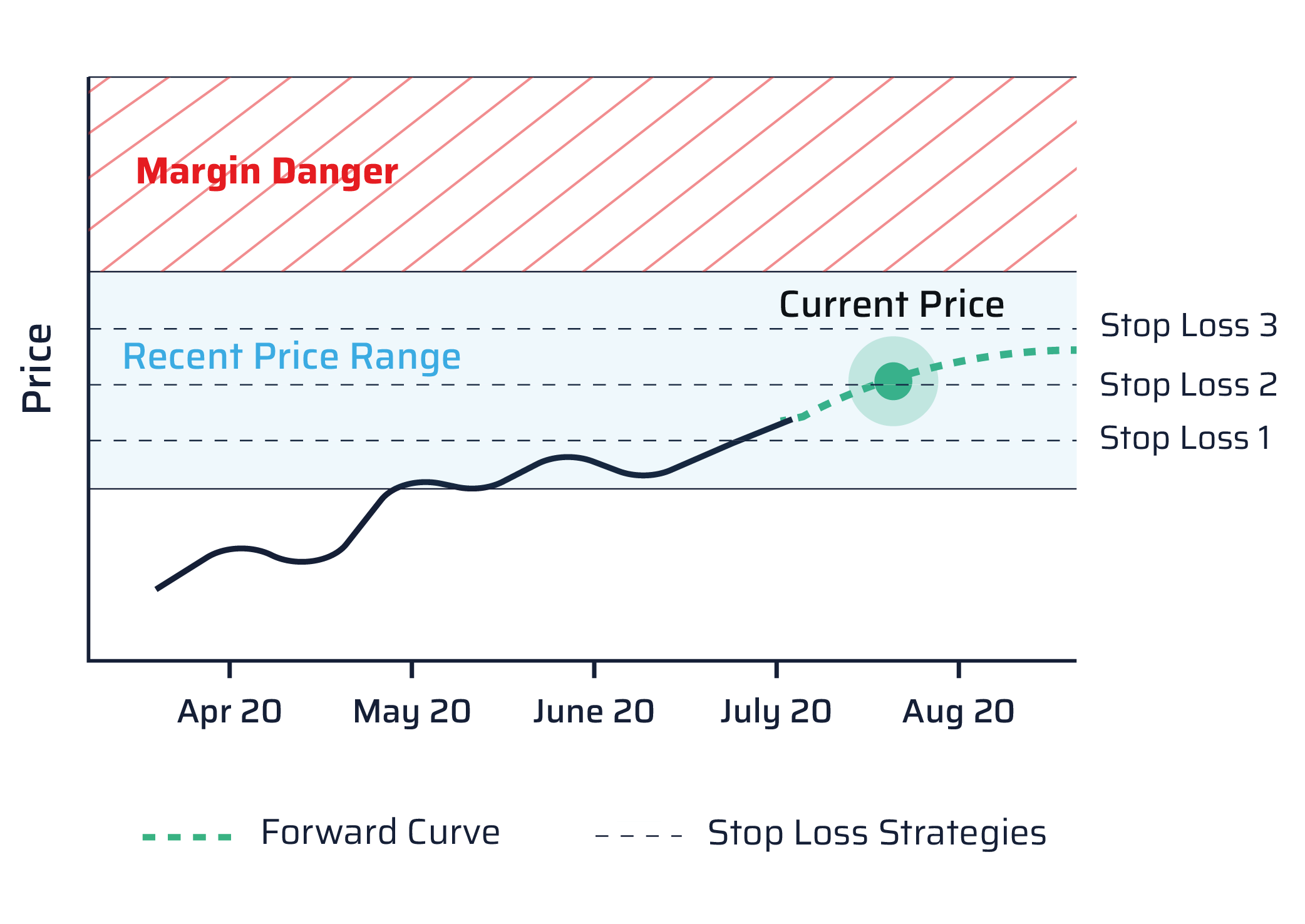

SolutionThe beverage company engaged AEGIS to identify and quantify its aluminum price exposure within the procurement process. AEGIS assisted the company in establishing an internal risk group to monitor and document its commodity exposures.With the infrastructure in place, the AEGIS team worked with the company to implement and execute a hedging program using financial hedges to offset aluminum price risk. Hedges were executed with well-capitalized banks and the company had full transparency to current market conditions - ensuring the prices were fair and efficient. A “stop-loss” strategy enabled the company to benefit as aluminum prices declined and strategically limited its exposure to further price increases as the market marched higher. Had the market subsequently declined, the company would have remained hedged, but not realized the full benefit of lower prices. |

OutcomeThe elements for success are now in place: an internal risk team, a strategy to recognize and adjust to market movements, and a partner to execute hedges efficiently. The company is better positioned to manage aluminum market fluctuations. The beverage company is now able to budget more effectively, forecast margins, and improve its competitive positioning - all while utilizing financial hedges that can easily be replaced and adjusted as demand changes. |

"We were referred to AEGIS by a trusted supplier. We needed better visibility into our aluminum exposure and more flexibility into controlling our aluminum costs. Working with AEGIS has allowed us to quickly benefit from hedging without the burden of hiring internal experts.” |

Leadership Team | Beverage Producer

Get market insights delivered to your inbox - for free. | |