Created under the Energy Policy Act of 2005, the RFS program represents a nationwide, market-based approach mandating the increased use of renewable fuels in the petroleum-transportation fuel pool. The law displaces higher greenhouse gas (GHG) emitting petroleum-based fuels with lower lifecycle GHG biofuels as higher RIN prices act as an incentive to blend larger volumes of biofuels. The law was expanded significantly in 2007 under the passage of the Energy Independence and Security Act (EISA) to build out five RIN categories—commonly referred to as RFS2.

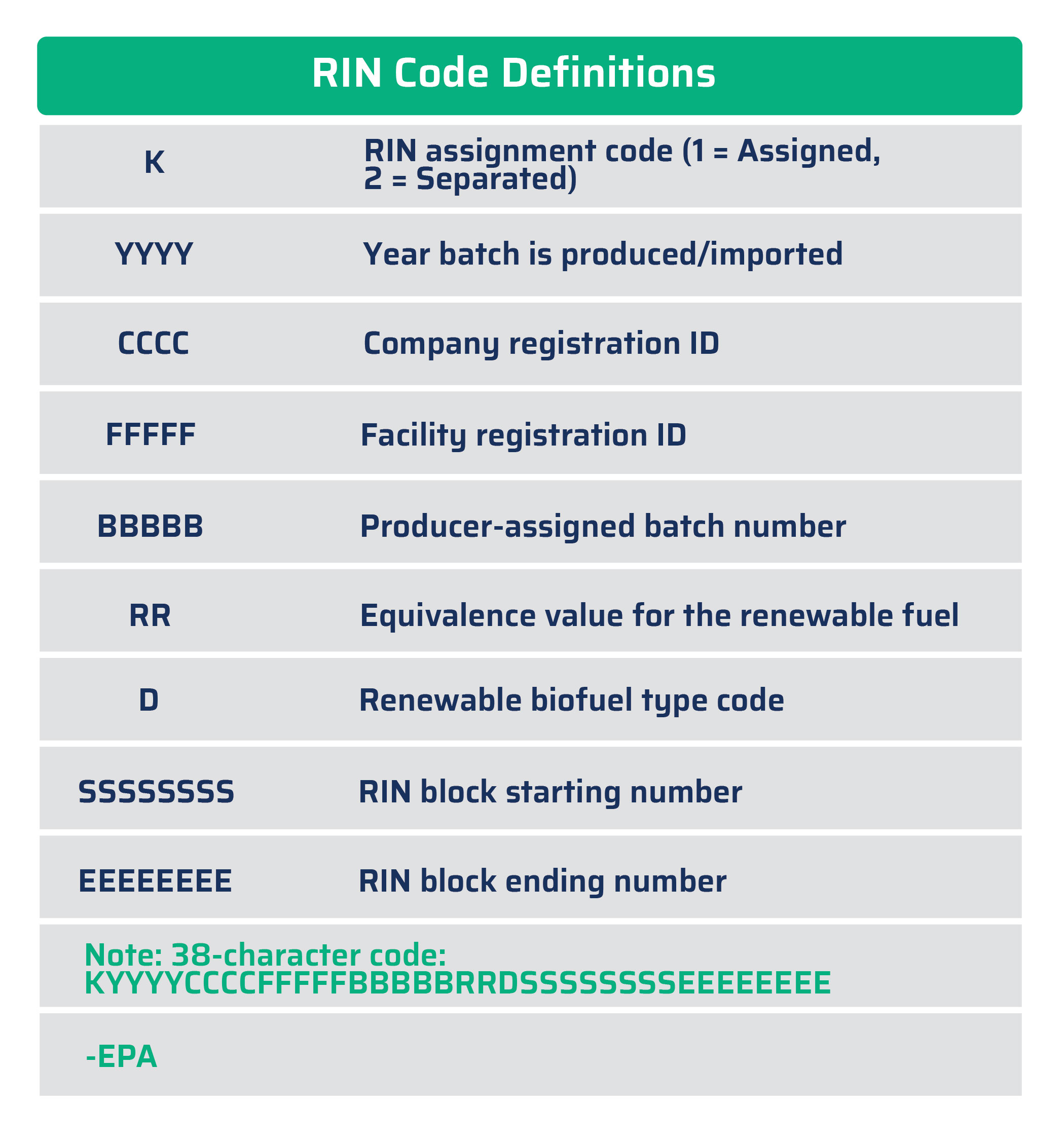

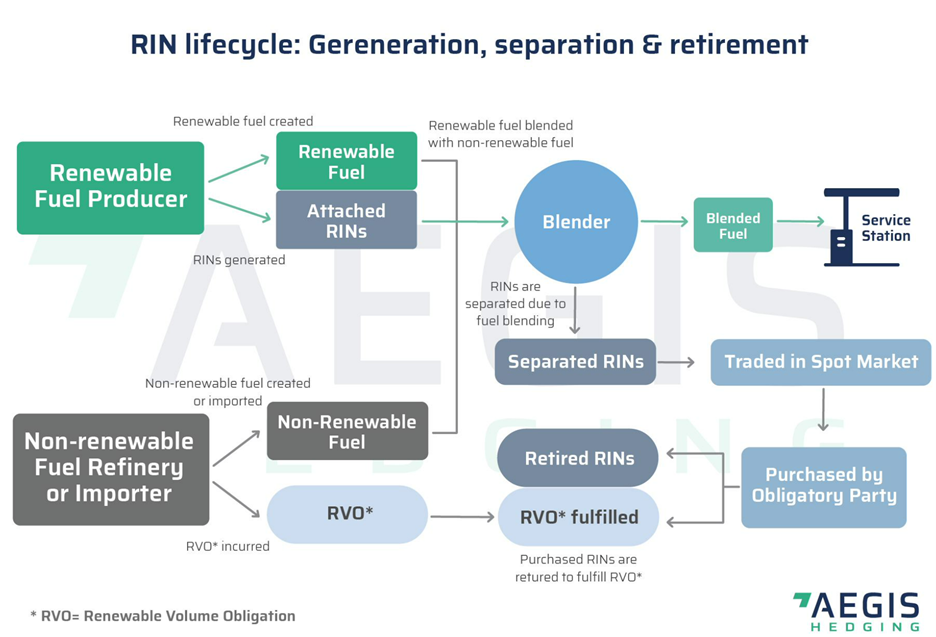

Under the RFS, a RIN is generated at the point of production of the biofuel. A RIN is a 38-digit alphanumeric code representing a batch code for every single gallon of fuel generated at each facility or imported to the US. Once blended with petroleum-based fuel, RINs can be separated and traded to obligated parties (OPs) required to retire RINs to demonstrate compliance with the program.

Under the RFS, OPs include refiners of petroleum products as well as importers of on-road fuels such as gasoline or diesel. Blenders mixing biofuels into the motor-fuels pool are net generators of RINs; OPs may buy these credits. OPs can also export on-road fuels to diminish their overall obligation. RINs are attached to the biofuel until the point of blending at which point they are separated and can be traded between longs and shorts.

OPs must acquire a certain amount of RINs by the compliance deadline, at which point the RINs are retired to demonstrate compliance with the RFS. RINs have a lifespan of two years and up to 20% of an obligation can be met with prior year RINs, though this option cannot be used in consecutive compliance years.

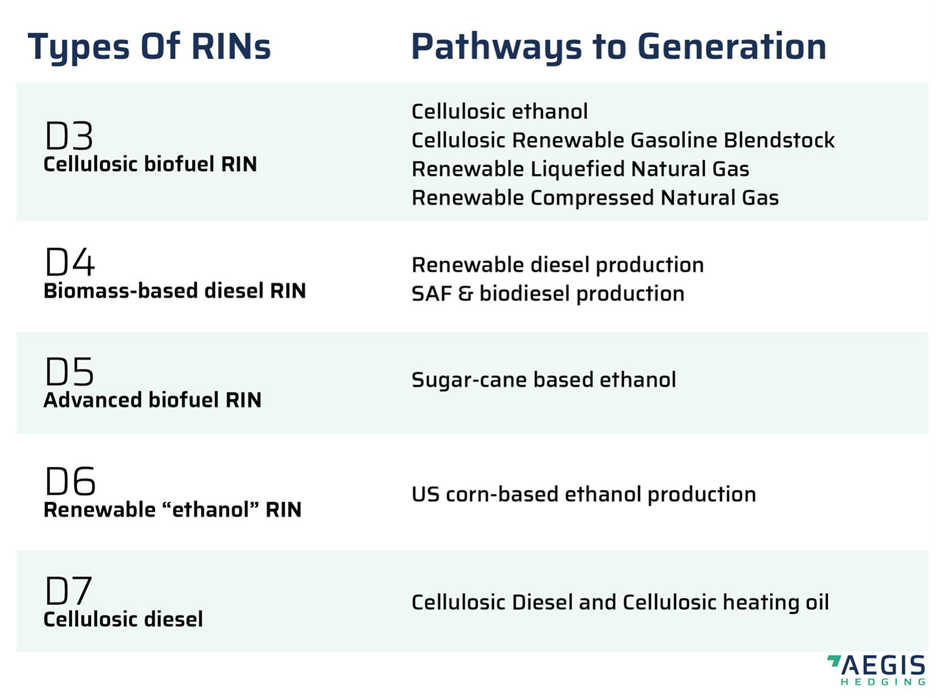

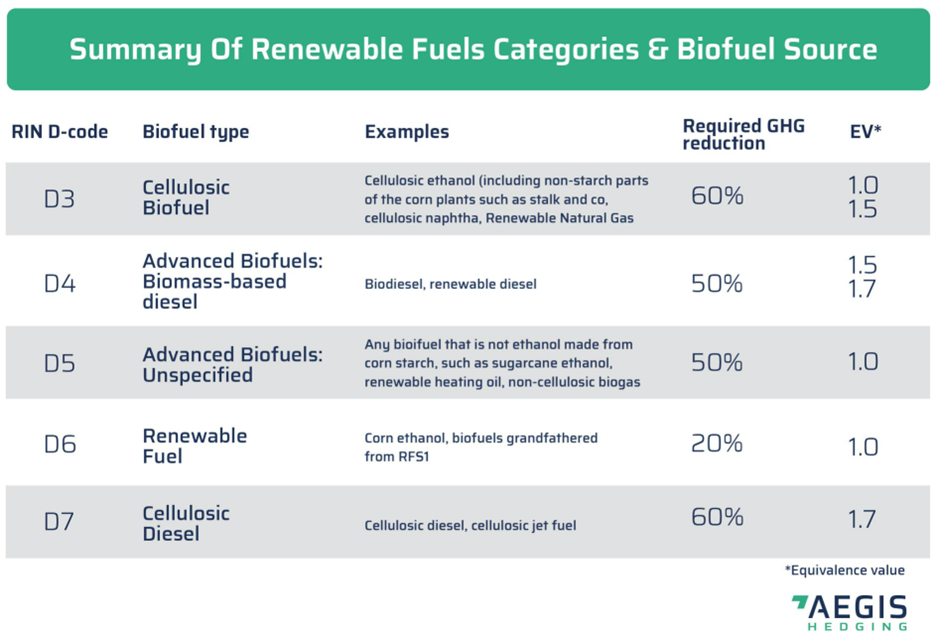

RINs are distinguished by D-code—indicating GHG reduction—and vintage. The following breaks out each D-code and explains common method(s) of generation:

The vintage of a RIN is the year in which the fuel and associated credit was produced. Depending on the mandate for a given year i.e., the demand side as well as the existing supply and ability to blend, the vintage can be a large factor in determining pricing.

D6 RINs are by far the most common with roughly 15 billion credits generated each year through the blending of US corn-based ethanol into the US gasoline pool at a 10% blend. Known as E10, this is the regular blend of ethanol available at most pumps. Higher blends such at E15 and E85 are available at some stations, yet demand remains constrained by lack of consumer education, infrastructure costs and the risk of damage to engines.

While ethanol is high octane with a rating ranging around 110-115 octane, the RVP is very high at 17-18 psi which limits the amount of ethanol which can go into higher blends, particularly E85. E10 already requires a 1.0 RVP waiver during the summer months, while E15 requires a second. E85 runs between 51% to 83% ethanol because of RVP constraints, despite pump labels claiming ethanol content up to 85%. More ethanol can be used during the winter, when higher RVP is allowed. Ultimately, higher blends are an issue of consumer education and demand, which has only increased in some regional pockets of the country.

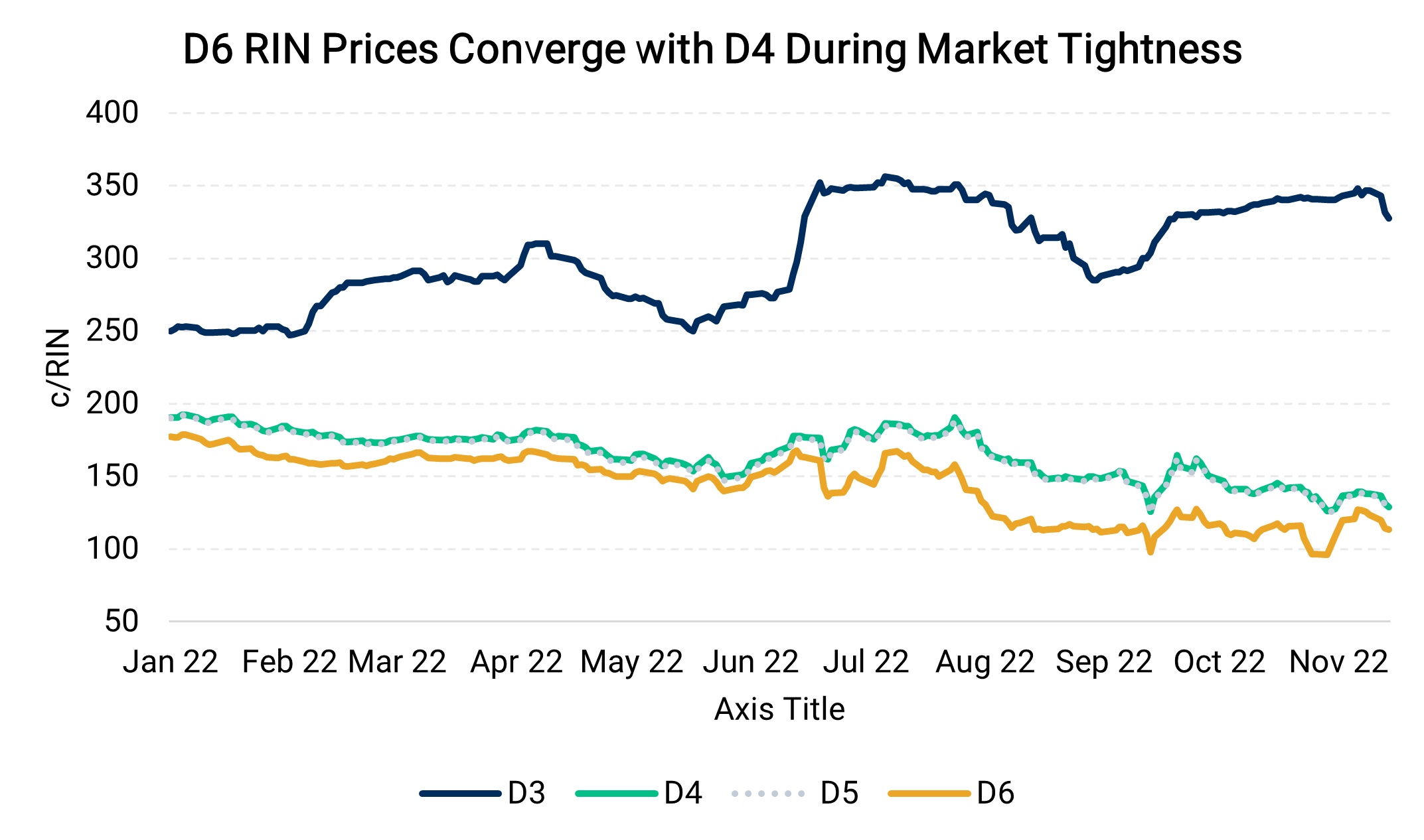

Since ethanol in practice can only really make up 10% of the US motor gasoline pool, this represents the “blendwall” for the D6 marketplace at which point D6 prices will converge toward more expensive D4 credits (see case study RIN-sanity 2013).

Two main types of biomass-based diesel are "biodiesel" and "renewable diesel." Renewable diesel has recently overtaken the biodiesel industry as the primary source of D4 credits, following a substantial period of growth for the RD industry over the past two-and-a-half years. Since the RFS’ inception, biodiesel had been the primary source of D4 biomass-based diesel RINs.

Roughly 70% of biodiesel is sourced from soybean oil and other vegetable oils such as canola oil in the US—soy methyl ester (SME), with the remaining product produced from tallow—fatty acid methyl ester (FAME). Biodiesel is qualified renewable fuel, but it has different chemical and physical properties from normal petroleum-based diesel as well as renewable diesel. Due to biodiesel’s poor cold weather properties, producers use soybean oil during colder months and limit blend rates in certain regions. During the summer, tallow-based product can enter the marketplace without fouling up of fuel systems.

Renewable diesel is a higher quality product produced by running renewable feedstocks in a hydrotreater in the presence of a catalyst. The product is chemically indistinguishable from petroleum-based diesel fuel and is used as a drop-in fuel (a direct substitute). It can be injected into pipelines and comingled with conventional diesel.

The most common feedstocks for renewable diesel are used cooking oil and distillers’ corn oil. These feedstocks have low carbon-intensity scores, which makes RD more valuable in its two largest markets, California and Oregon. In those states, RD gains additional Low Carbon Fuel Standard (LCFS) credits not available in other states. Other feedstocks include soybean oil, bleached fancy tallow, technical tallow, yellow grease, choice white grease, canola oil, poultry fat, and refined bleached deodorized soybean oil.

Sophisticated facilities can switch between feedstocks and even run multiple streams. The least sophisticated plants lack on-site pretreatment facilities, requiring the purchase of only the highest-quality feedstocks or risk damaging expensive equipment and catalysts.

Last, cellulosic RINs are primarily generated through biogas to produce Renewable Natural Gas (RNG). Biogas is sourced through municipal solid-waste facilities, landfills, and anaerobic digestion. These fuels earn D3 RINs. Prior to the approval of these pathways, obligated parties were essentially required to buy fuel which wasn’t available in marketable quantities. To facilitate this, the EPA created the cellulosic waiver credit (CWC) which, when paired with a D4 or D5 credit, would satisfy the cellulosic requirement. The CWC played a large role in dictating the price for D3 RINs as a liquid market was not yet available. Yet, following a surge of biogas projects particularly from 2014 through 2022 (when the number accelerated rapidly), the cellulosic market now finds itself largely oversupplied. The D4 RIN sets the theoretical floor for the cellulosic market. The CWC+D4 represents the price ceiling, also referred to as the "alternative price of compliance."

Fuels with more energy content generate more RINs. The baseline for comparison is ethanol. One gallon of ethanol generates one D6 RIN, but more energy-dense fuels can generate more RINs per gallon than ethanol. Biomass-based diesel generates 1.5 RINs per gallon, while Renewable diesel earns 1.7 credits per gallon. This is known as a fuel’s "equivalence value."

Given the importance of equivalence value, it is important to know if ethanol-equivalent gallons or true gallons are being discussed when examining advanced biofuels. The EPA almost exclusively uses ethanol-equivalent gallons unless otherwise stated. The EPA will often list its biomass-based diesel mandates in biodiesel-equivalent.

RIN categories are further distinguished by their greenhouse gas (GHG) reduction compared to a 2005 petroleum baseline.

A RIN code is structured as such:

RIN = KYYYYCCCCFFFFFBBBBBRRDSSSSSSSSEEEEEEEE

Where:

K = Code distinguishing separated and attached RINs

YYYY = Calendar year of production of import

CCCC = Company ID

FFFFF = Facility ID

BBBBB = Batch Number

RR = Code identifying Equivalence value

D = Identifies renewable fuel category

SSSSSSSS = RIN start block codeEEEEEEEE = RIN end block code

A RIN is not a physical object, but more like a digital certificate. RINs do not require physical storage in a tank or require the use of logistics like the commodity markets in which the credits are generated. The RIN market represents billions of unique codes tracking biofuel trading and blending within the refined products arena. Originally, RINs were housed in spreadsheets and on hand-written contracts and were largely an accounting practice. Now RINs are stored with the EPA’s EPA Moderated Transaction System (EMTS) which records everything from RIN generation, transactions and separations to holdings, trading, and retirements. Since 2013, RINs have become a critical balance-sheet item, and they often determine a refiner's profitability. During periods of high prices or high regulatory uncertainty, discussion on refiner earnings calls is often dominated by RIN prices and RIN procurement strategy.

RIN Generators: US biofuels producers and foreign producers generate RINs, which are attached to the biofuel they produce.

Blenders mixing biofuels with gasoline or diesel separate the RINs at the point of blending. The RINs can then be sold in the OTC market.

Obligated parties with access to blending can mix biofuels and strip-off RINs to meet their obligations, save them for later, or sell to other OPs.

RIN demand and obligated parties:

US refiners and importers of refined on-road fuels require RINs to cover their unique RFS blending obligations.

RINs can act almost as a punitive tax on certain refiners which are net-short RINs due to their operational structure (i.e. those with no blending infrastructure).

For exporters of refined on-road fuels, RINs act as a discount. The obligation to purchase RINs is obviated, because the fuels will not be consumed in the US.

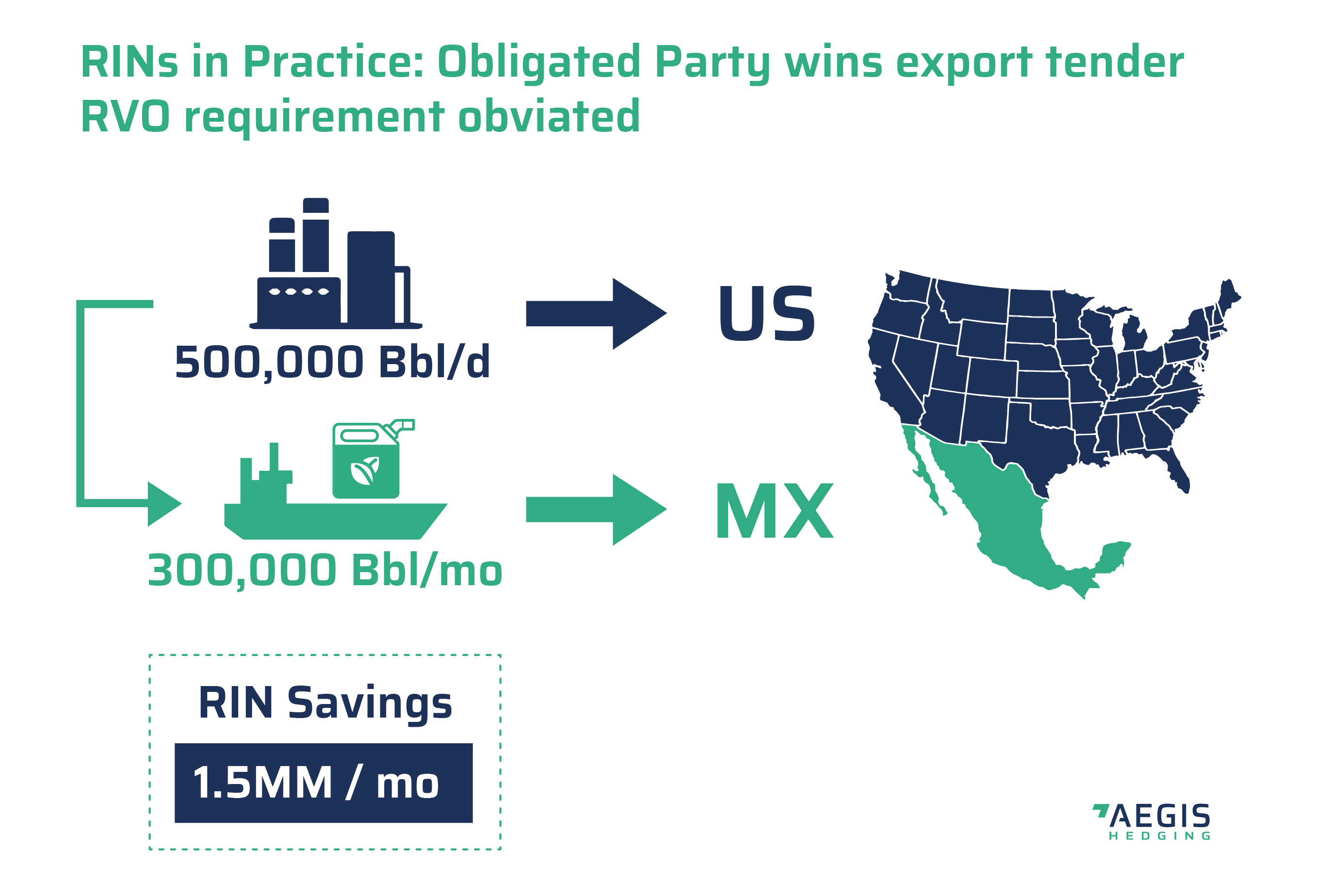

A refiner (an obligated party in this example) expects to produce 500,000 Bbl/d for 2022 and anticipates using all the production to meet US demand.

The refiner will incur an obligation to purchase over 2.46 million RINs each day to cover its requirements to the EPA, or roughly 74 million RINs per month.

The refiner wins a tender to supply a 300,000 Bbl cargo of diesel to Mexico each month. Exported fuel does not require a RIN purchase.

The 300,000 barrels would have incurred nearly 1.5 million RINs if the fuel was used domestically. This savings can then be passed on to the buyer of the cargo as a discount.

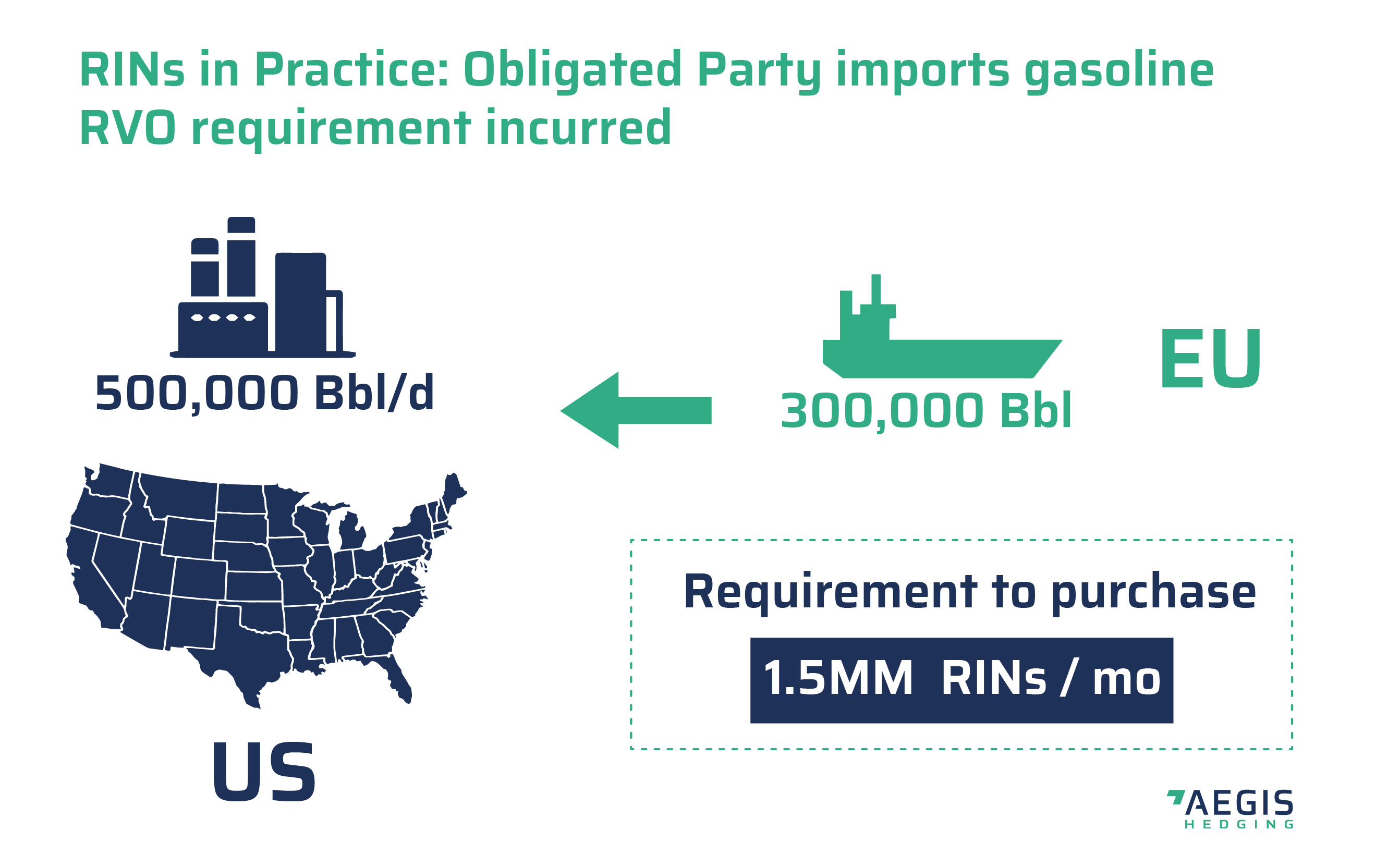

This same 500,000 Bbl/d refiner renews a contract with a client requiring 300,000 more barrels per month of gasoline than the previous contract. The refiner turns to the import market to cover the monthly obligation and finds a supplier.

The 300,000 barrels of imported gasoline is now consumed in the US, requiring an additional 1.5 million RINs. The refiner must turn to the OTC RIN market to purchase credits to cover its expanded obligation.

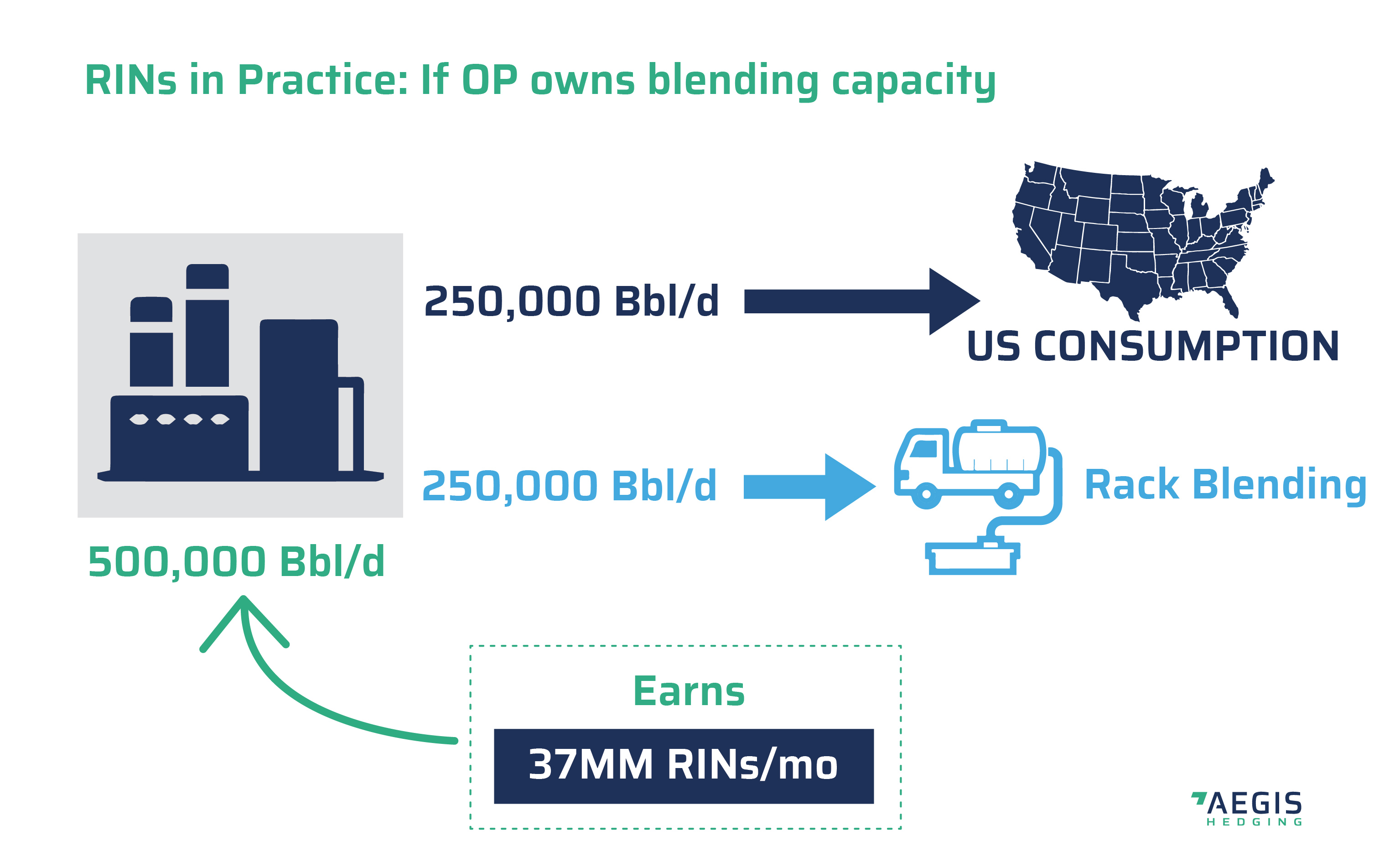

A 500,000 Bbl/d refiner aims to dedicate its entire yearly production to meet US demand. Yet this refiner has downstream blending capacity, allowing it to blend up to 50% of its production with biofuels. In the absence of blending capacity, the refiner would have required 74 million RINs per month to cover its obligations.

However, with the RINs generated through the OP’s integrated blending, the OP obviates the need to purchase nearly 37 million RINs per month.

Not all obligated parties are in the same situation with respect to the RFS. Some OPs added blending capacity as a response to the demands of the RFS.

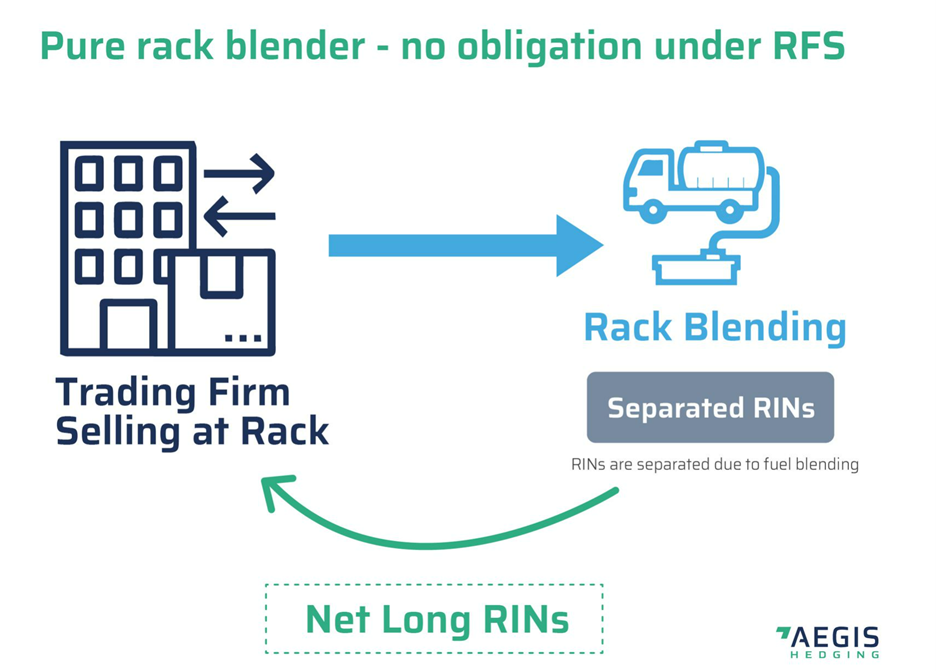

A downstream company positioned to sell at the rack (where tanker trucks buy blended fuel for distribution to retail) would be in the position of a net long RIN generator. The company would purchase wholesale, spot diesel and gasoline, and then blend biodiesel and ethanol, respectively, at the rack. This blending generates RINs.

Because the downstream operator does not produce nor import its fuel, the firm would not carry an obligation under the RFS. Thus, the RINs would be sold to obligated parties and factored into the firm’s rack margin.

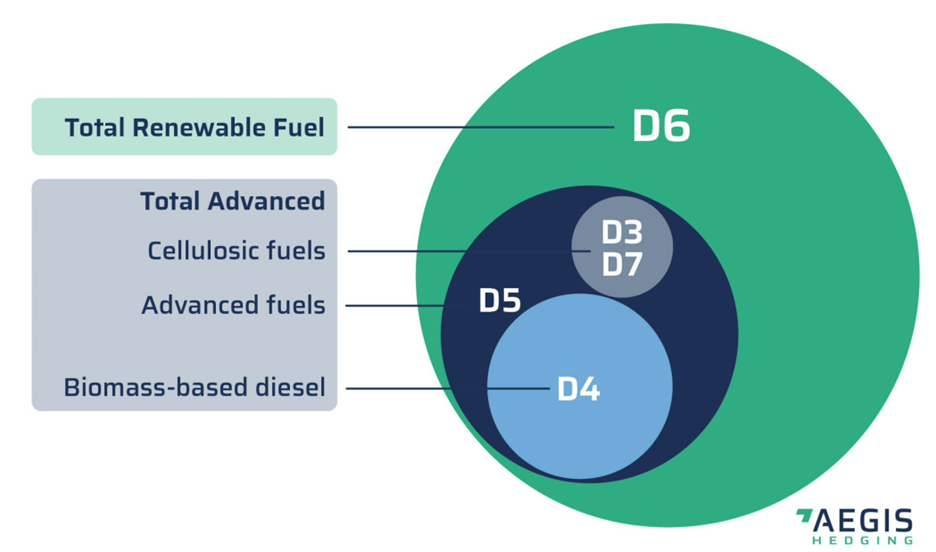

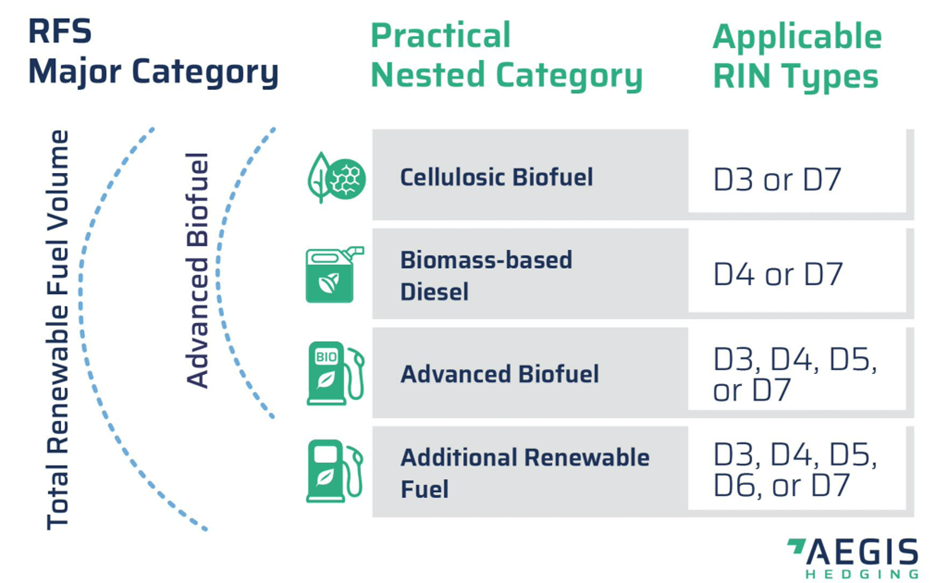

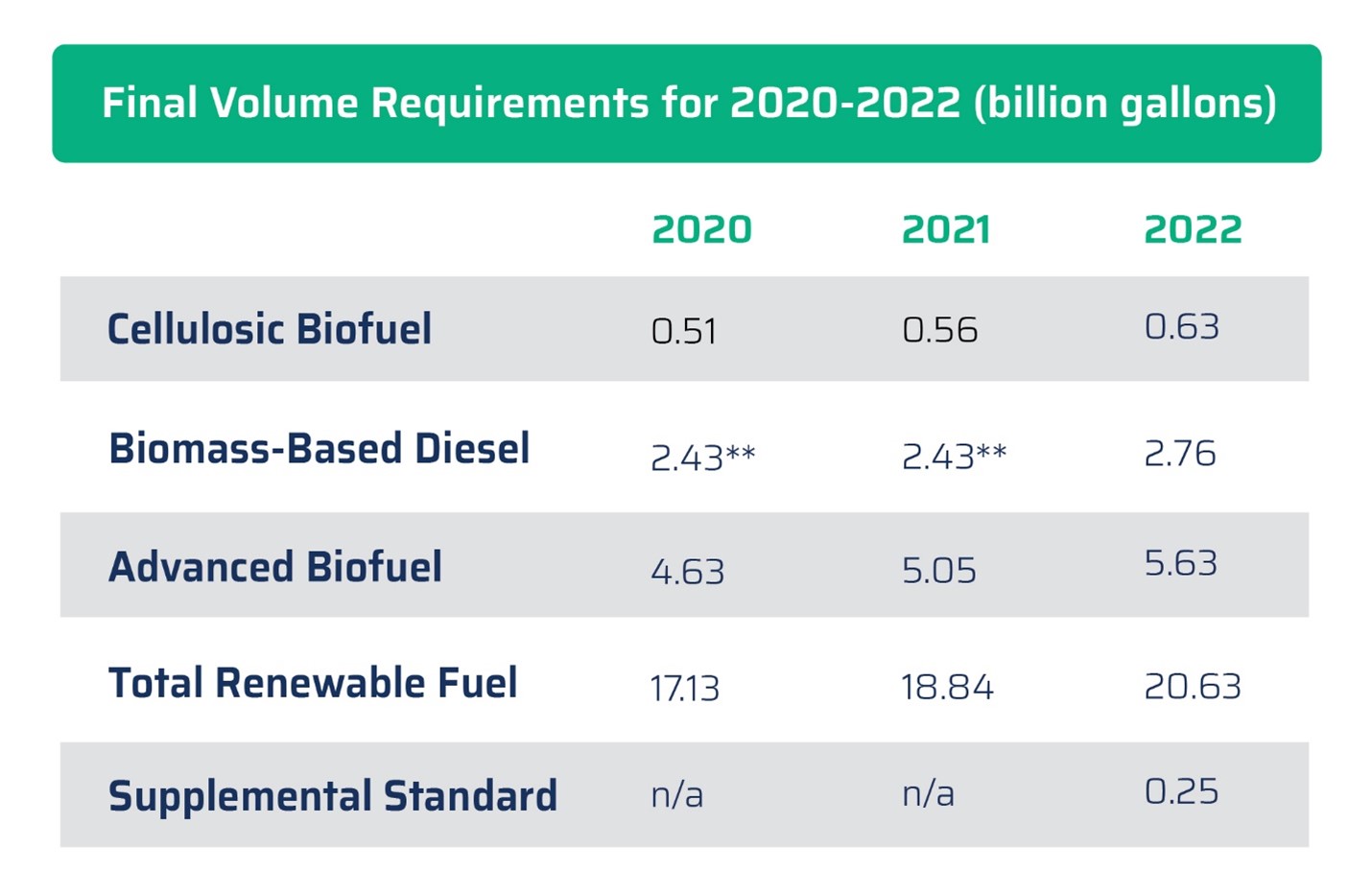

RIN categories under the RFS are nested to allow for double counting of certain credits toward the overall advanced biofuel and total renewable fuels requirements. This structure is known as "nesting." The RFS releases its rulings in a nested format. To understand the requirements for each RIN category, one must de-nest the credits.

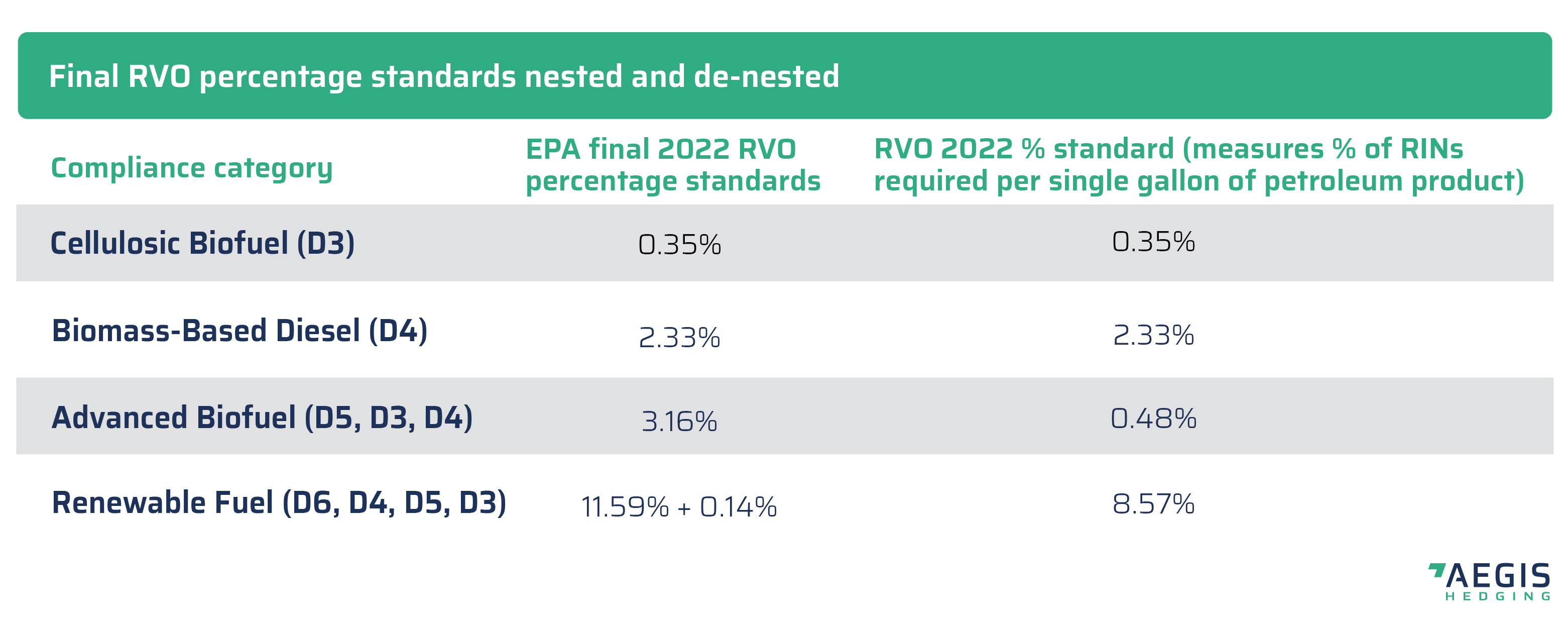

The total renewable-fuel or D6 obligation is calculated by subtracting the total advanced biofuel requirement from the total renewable fuel mandate. While the remaining D3, D4, D5, and D7 credits could be used to meet the total renewable fuel requirement, one type of RIN is usually the best choice. Different pricing among the types of RINs dictates that OPs seek to meet the de-nested renewable fuel obligation using solely D6 RINs.

D3, D4, D5, and D7 RINs can each be used to meet the total advanced biofuel requirement. In the diagram above, inner circles can be used to satisfy RIN requirements in a circle that encompasses it. For example, a D4 can satisfy a D5, or a D6, but not a D3 or D7. A D3 or D7 can satisfy a D5. A D5 could satisfy a D6. However, due to differences in pricing, OPs would never buy more than the bare minimum of more expensive cellulosic credits to meet anything beyond just the cellulosic biofuel requirement.

To de-nest the advanced requirement one subtracts the biomass-based diesel and cellulosic biofuel mandates from the total advanced requirement. From here both cellulosic and biomass-based diesel requirements are already de-nested, leaving one with the remainder of the advanced biofuel mandate which would in practice be met using a combination of relatively more affordable D4 and D5 credits.

In late 2012 and early 2013 it became clear that the EPA’s mandated volumes for ethanol to be blended with gasoline were too high. Falling gasoline demand shrunk the gasoline pool in which ethanol could be blended at a max 10%.

In February of 2013, the EPA released its target of 13.8 billion gallons for ethanol blending and a total mandate of 16.55 billion gallons of renewable fuels.

In late February, D6 RINs, which had previously been trading for as little as $0.01/RIN - $ 0.05/RIN, rallied to over $1.00/RIN as OPs scramble to purchase credits to satisfy compliance with the 2012 RFS by the 28 February 2013 deadline. Underpinning this strength was the realization that 2013 gasoline demand would not support the more stringent 2013 ethanol requirements. A defined volume of ethanol must be blended (or RINs purchased to cover the gap), but there were fewer gasoline barrels in which to blend ethanol. OPs would likely draw heavily on previously banked RINs – tightening the market.

In effect, D6 RIN prices surged to meet—and even occasionally exceed—the price of the D4 RIN as the biomass-based diesel credit could be used to break through the blendwall. This narrowing of the D4-D6 spread is often referred to as "convergence" as the cheaper D6 RIN climbs to the more expensive D4 RIN signaling tight RIN supply. Conversely, a wide D4-D6 spread would indicate a well-supplied D6 marketplace, all else equal.

The run-up in RIN prices in February of 2013 led to burgeoning RIN costs for OPs, which had just a month earlier been acquiring credits for half a cent. The EPA was forced to act by trimming the original federal RVO mandate to account for the reduction in gasoline demand. RIN markets quickly corrected downward, making RINs the most volatile commodity on the planet that year with roughly 20,000% volatility.

The RIN market has remained elevated ever since the 2013 RIN-sanity rally as rising mandates set by the RFS replace an increasing proportion of the motor fuels blend pool. This has required more blending, purchases of RINs (paper blending), and/or drawdowns on banked RINs.

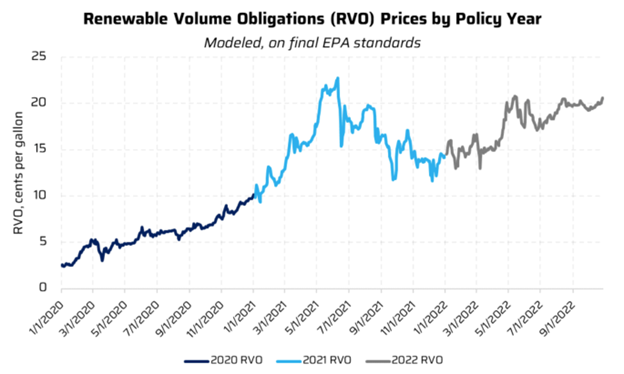

There are two ways to understand the Renewable Volume Obligation (RVO). The original meaning is the total volume of renewable fuels that the EPA requires to be blended into domestic road fuels. However, RVO can also be described as a cost of RFS compliance if we apply RIN market prices to the EPA's total volumetric blending requirement. As a market measure, RVO is the cumulative RIN obligation per USG. Each obligated party has a unique obligation and acquires RINs at different prices in the marketplace.

Existing longs (OP owns too many RINs) or shorts (does not own enough) in the current year or carryover, prior year credits can also alter each company’s overall RVO at a given time. Thus, the RVO price is a constantly moving target as RIN values and obligations shift constantly.

Because all on-road fuels carry an RFS obligation, the RVO is the average total cost of compliance for each gallon of gasoline or diesel consumed or imported to the US. While, jet fuel and heating oil are exempt from RFS obligations, blending renewables into these fuels can generate RINs.

Obligated parties must purchase a certain amount of each type of RINs to meet their total obligation. The EPA issues percentage standards in a nested structure when proposing or finalizing mandates. The sum of the de-nested percentages applied to the prevailing RIN prices equal the total Renewable Volume Obligation.

If we return to the examples of RINs in practice, an OP's main concern is the RVO, described as a cost of compliance per gallon. In our example above, the refiner that won the export tender reduced its overall requirement to buy RINs. The company uses either its own internally calculated RVO or a third-party index RVO to determine the savings. The savings can result in a discounted fuel price. Third-party RVO can be written into the export contract as a line item for discounting the fuel, because the refiner no longer needs to purchase the RINs.

In contrast, the refiner that had to turn to the import market to cover its larger gasoline commitment will now incur an obligation to buy a mix of RINs equating to the RVO. The cargo will be sold on an ex-RVO basis—i.e. discounted by the cost of RVO—because the buyer will need to purchase RINs for the domestic use of gasoline.

RIN markets developments: The 'Set Rule' and Inflation Reduction Act

Upcoming government action may change how RINs are priced.

Announced on December 1, the EPA's proposed 'Set Rule' lays out the nation's blend mandates for various renewables from 2023 through 2025. The 'Set Rule' came in well under expectations for the advanced category considering the rapid pace of development in the renewable diesel sector. Ethanol requirements of 15.25 billion gallons for each year saw D6 RINs firm, narrowing the D4/D6 spread. Elsewhere, renewable feedstocks like soybean oil, distillers' corn oil, used cooking oil and tallow corrected downward in anticipation of softer demand. Add in additional interconnected variables like Nymex ULSD, LCFS credits and logistics constaints and the volatility of the wider renewable complex is evident.

The EPA public comment period kicks off virtually January 10, 2023, with the deadline for finalized targets still set for June 14, 2023. though this could change as the EPA has been gratuitous about extending compliance deadlines given a long history of missed deadlines and retroactive rulings. The comment period is set to be contentious given the lower advanced mandates of the 'Set Rule' as well as the EPA's proposal to remove the cellulosic waiver authority.

Looking forward, The Inflation Reduction Act (IRA) which is set to work alongside the RFS to build a federal, carbon-based credit system to operate in concert with RINs. The IRA also carves out the new Clean Fuels Production Credit (CFPC) 45Z following the expiry of the Blenders’ Tax Credit (BTC). The BTC has supported biodiesel, renewable diesel and sustainable aviation fuels (SAF) blending for decades. The IRA also increased the subsidy for carbon capture and storage (CCS) by raising the 45Q tax credit.

How the new tax credits set out in the IRA will function is not entirely clear as the Internal Revenue Service (IRS), rather than the EPA, will have to publish the guidelines and regulations before 2025. It is also not clear how the 45Z and 45Q will impact GHG-guided RIN markets.

With regulatory uncertainty and interpretation an ever-present facet of conducting business in the renewables arena, we encourage the reader to reach out to AEGIS Hedging for advisory and hedging services.