Updated September 17, 2024

Recent News:

(February 22, 2024) - Chord Energy's acquisition of Enerplus for $3.8 billion, forming the Bakken Shale's biggest producer, will boost its output to 287 MBoe/d and create an $11 billion enterprise with nearly 1800 undeveloped locations breaking even at $60/Bbl oil prices

(February 3, 2023, Argus) - The Army Corps is expected to release a long-anticipated environmental review of the Dakota Access Pipeline (DAPL) this spring. Opponents of the pipeline were in a battle in the courts even before the DAPL's commissioning in 2017. After the Army Corp EIS study is complete, a 45-day public comment period ensues. The final version of the EIS will lead to a record of the decision on the easement from the Army Corps, which could have consequences for the pipeline, according to the Harvard Law School's Environmental and Energy Law Program (EELP).

|

Hedging Considerations: Using financial derivatives to hedge price risk at either Clearbrook or Guernsey can be difficult. There is little or any liquidity in forward pricing for Bakken-linked crude differentials. Many counterparties do not make a market for these prices; if they do, spreads can be quite wide. |

| Price |

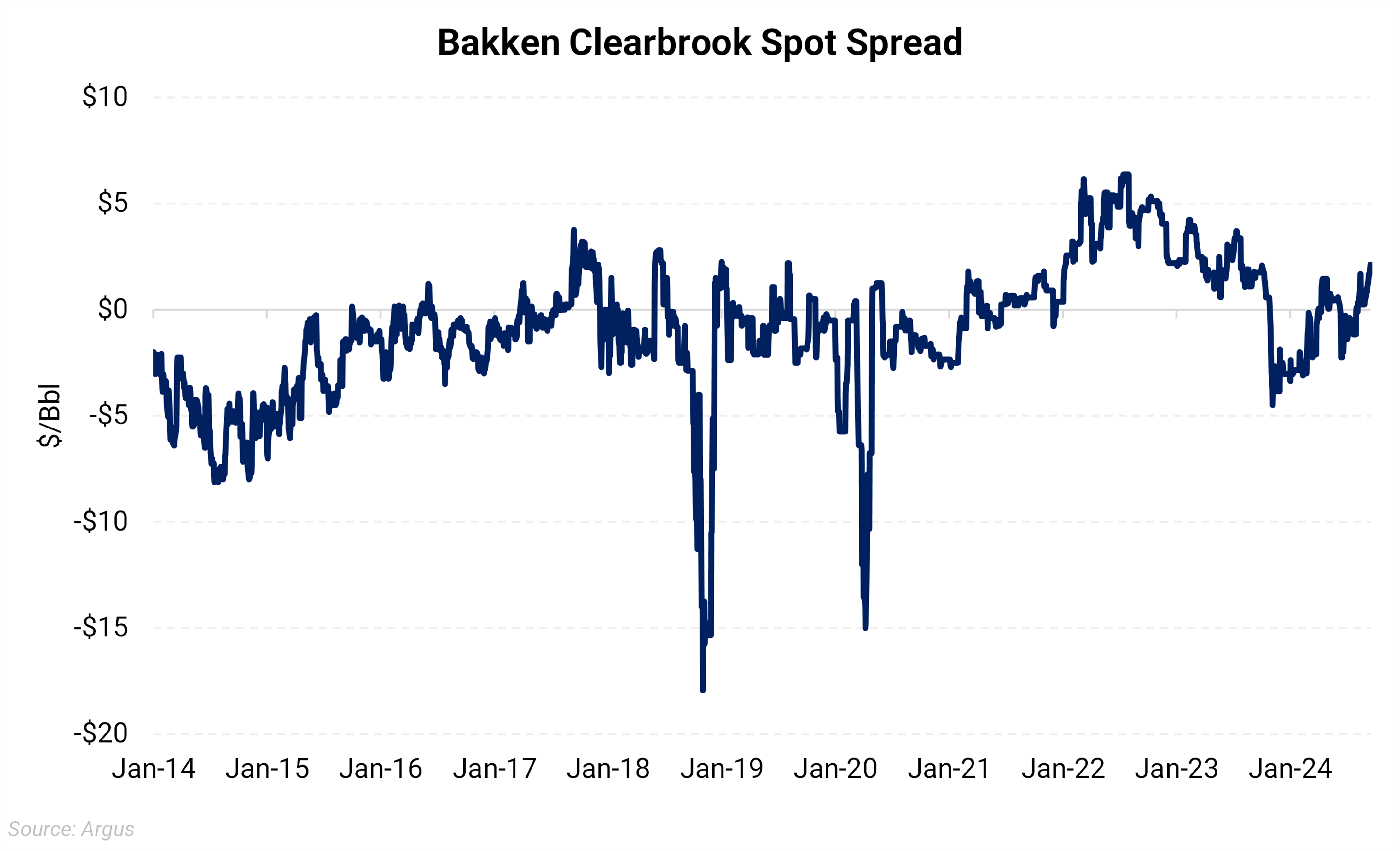

September 17, 2024 - Oil prices in the Bakken usually trade at a discount to WTI. The Bakken-WTI spot spread has seen support recently, trading at a premium due to a widening Brent-WTI spread. This trend is driven by the increased incentive to ship Bakken barrels south to the Gulf Coast, especially as the Brent-WTI differential rises, making Bakken crude more competitive. Since differentials flipped to a premium, prices have been relatively stable at around $2/Bbl. However, it is important to note that liquidity in Clearbrook forwards is extremely thin, leading to significantly wider than average bid-ask spreads. Many producers in the region opt to hedge physically rather than financially for this reason.

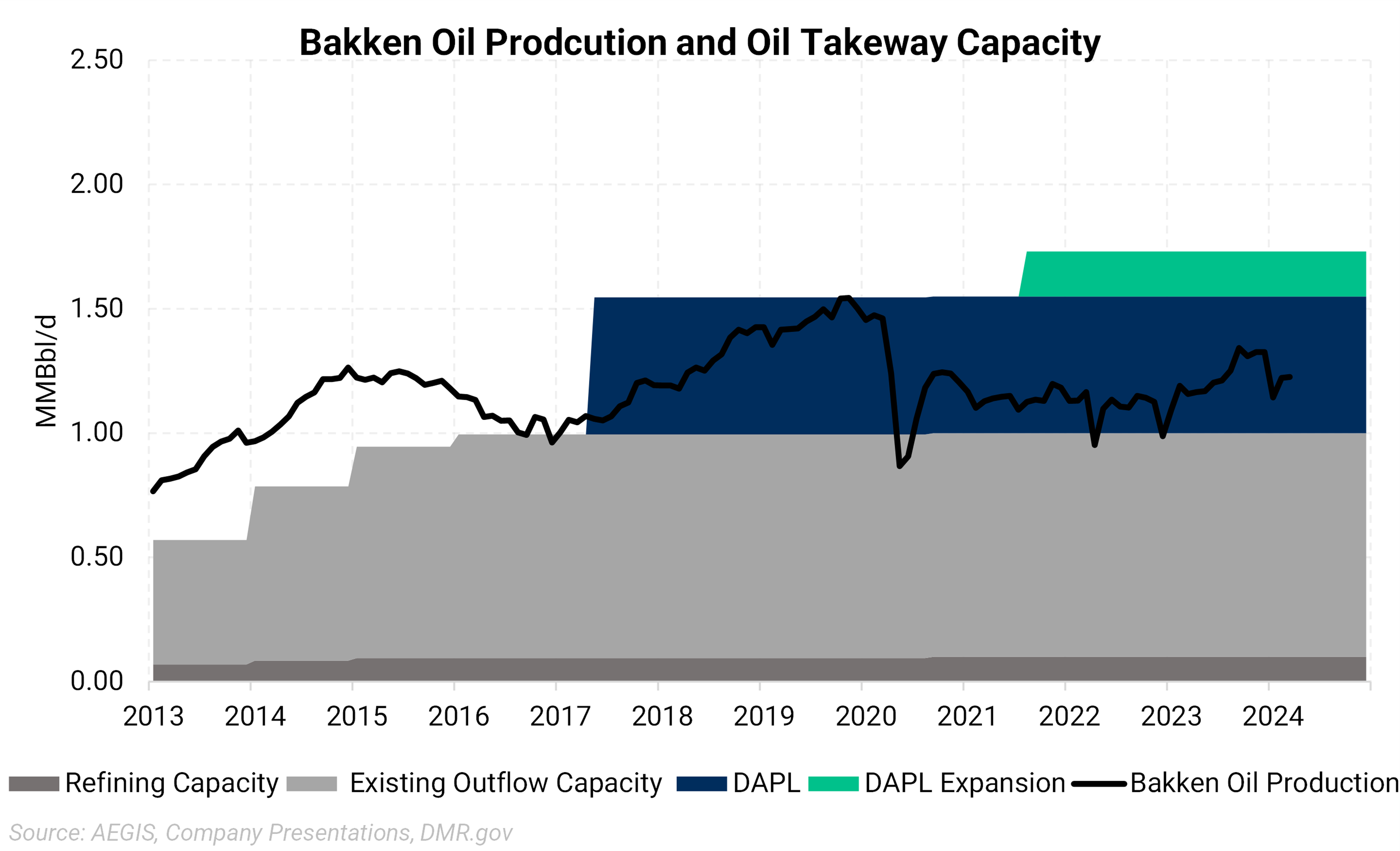

Although Bakken production is slowly growing, effective crude oil takeaway capacity is much tighter than nameplate capacity would suggest, especially due to inefficiencies with rail and the Bakken North line. With key pipelines like NDPL and Pony Express expected to reach full capacity soon, DAPL stands out as the most viable option for absorbing the growth in Bakken oil production.

| Bakken Shale Overview |

|

Geology The Williston Basin, compared to many basins worldwide, is a structurally simple basin. It is roughly circular, deepest in its center, and the strata become both shallower and thinner towards its margins. It is a large basin, covering approximately 150,000 square miles over parts of North Dakota, South Dakota, Montana, and parts of the adjacent Canadian provinces of Saskatchewan and Manitoba. The basin's deepest point is thought to be near Williston, ND, where the Precambrian surface is more than 16,000 feet below the surface. Crude Most of the crude oil reserves in the Bakken/Three Forks is a high-quality light sweet crude with an average API gravity of around 40. These traits make it very similar to West Texas Intermediate crude that is used for the NYMEX benchmark contract. Source: dmr.nd.gov, NGI

|

|

|

Major Bakken Pipeline Routes |

|

|

|

Key crude oil pipelines that serve Bakken oil producers

Source: EIA Key natural gas/NGL pipelines that serve the Bakken

Source: PointLogic

|

|

Rig Count As of June, active rigs in the Bakken have recently leveled off to around 34 rigs. This is slightly higher than this time last year but lower than the previous periods. |

Source: Baker Hughes

|

Production Growth |

|

Oil production has been relatively stable in the Bakken since late 2020, except for times when the region experiences freeze-offs. Further oil growth may depend on gas takeaway capacity. As operators are facing tough flaring restrictions, associated gas volumes can become the bottleneck in additional liquids growth. There is competition with Canada for space on gas pipelines leaving the region. If Bakken producers procure more capacity on pipes like Northern Border, then that would allow additional liquids growth. For oil, The region is overbuilt for crude takeaway capacity. The addition of DAPL, and its recent expansion, has created an overbuild of pipe capacity for the region as a whole. Before COVID, Bakken crude oil production peaked at 1.5 MMBbl/d but dropped to 900 MBbl/d during the pandemic. Despite some recovery, current production remains stuck around 1.2 MMBbl/d, significantly lower than its potential amid takeaway constraints. |

|

|

| Dakota Access Pipeline - The Dakota Access Pipeline (DAPL) is a 1,172-mile-long underground pipeline that can transport up to 750 MBbl/d of light sweet crude oil. The pipe originates in North Dakota in the Bakken formation and terminates in Patoka, Illinois. A separate Energy Transfer pipeline (ETCO) can then deliver oil to the Nederland terminal on the Texas Gulf Coast. | |