As Henry Hub prices have deteriorated to sub-$2.00/MMbtu, the prospect of a decline in production has increased, and it may be necessary to balance the market and prevent inventories from reaching near total capacity. Some large public producers, such as Chesapeake, have already begun discussing throttling production in 2024. However, supply can be challenging to forecast, so we have modeled several storage scenarios with various amounts of gas production to estimate the potential impact of a decline in output.

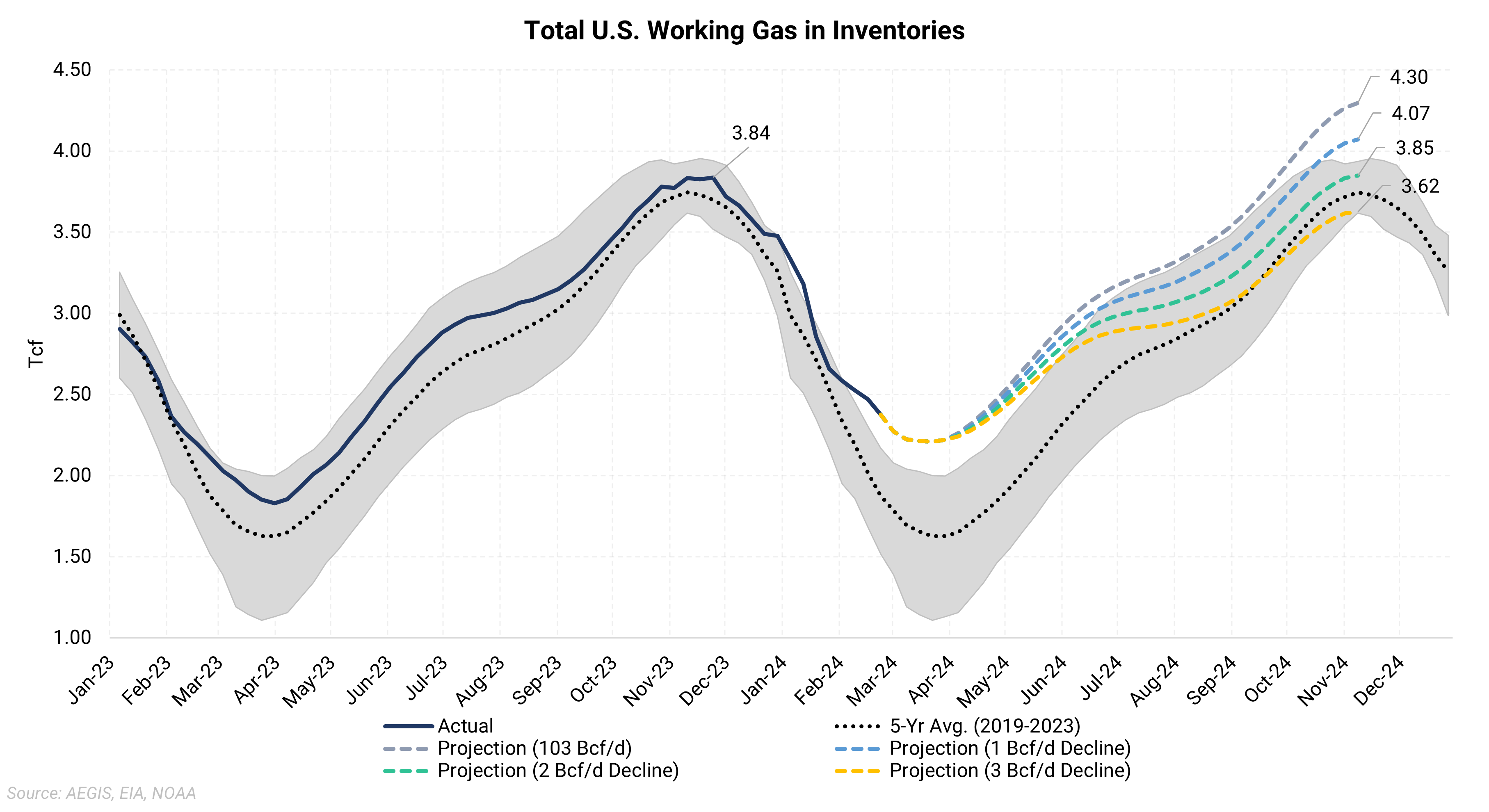

A few assumptions are included in this storage projection: ten-year average weather outside the next two weeks and a slight increase in renewables generation displacing some gas demand. The base projection uses a yearly average production of 103 Bcf/d, which leads to inventories climbing to a 4.3 Tcf (End-of-Season or EOS) by the start of next winter. We used a 103 Bcf/d average production level, close to what production averaged through 2023. One note about this amount of storage. It’s probably unlikely that storage would reach a 4.3 Tcf EOS as the gas market would adjust supply and or power at the cost of price. Either way, heading into next winter with 4.3 would be particularly bearish and much higher than where storage started this past winter.

Our three scenarios show a production decline ranging between 1-3 Bcf/d. Each scenario puts inventories closer to the five-year average, with the 3 Bcf/d decline scenario represented by the yellow line being the most bullish case. And by bullish, we mean for Winter ‘24-’25 and Cal 25 specifically since a reduction in supply in 2024 likely meant prices were low. Our scenarios are meant to illustrate what would be required to change storage by November of this year. Lower storage come November would come at the cost of gas price as supply reduction would be a function of lower prices forcing producers to cut back on supply.

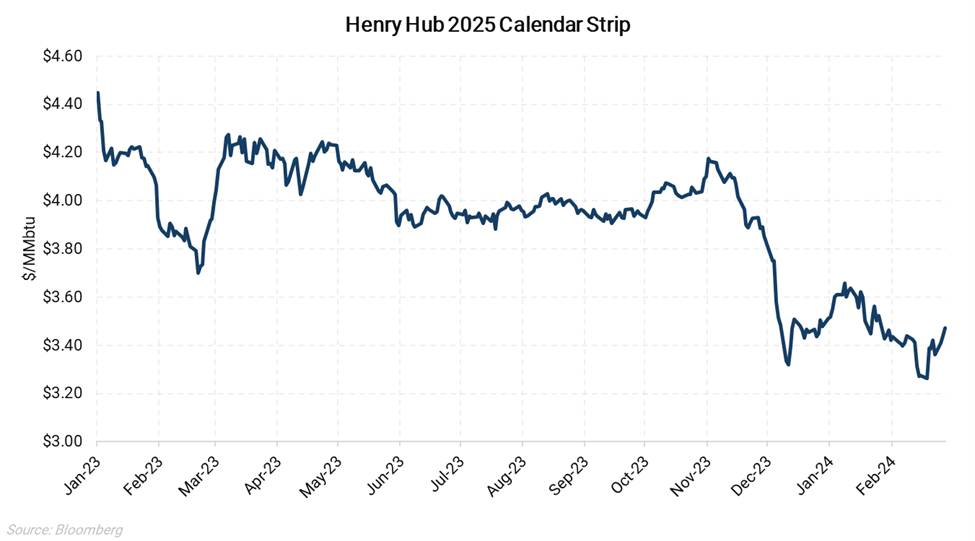

While the 2025 strip is still lower than where it traded through most of 2023, there has been a small rally in recent days following rhetoric from producers about cutting production.

Out of all S&D components, changes in production will likely be one of the most significant drivers of price action outside of weather. With several large public producers now guiding toward lower output in 2024, there is a good chance that gas production will fall, the magnitude of which is currently unknown. However, a material drop in production could lead to a rally in gas prices across the curve.