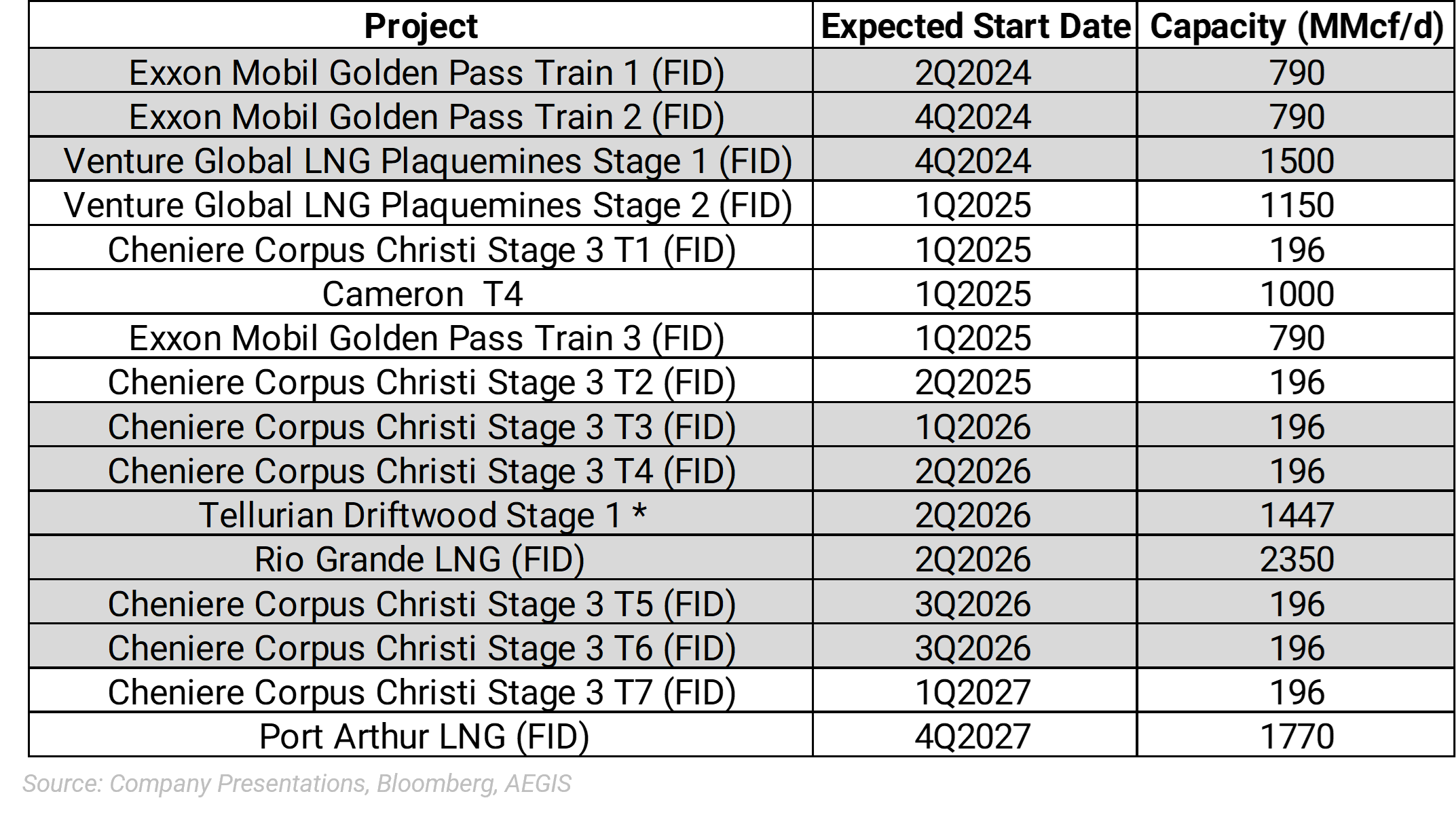

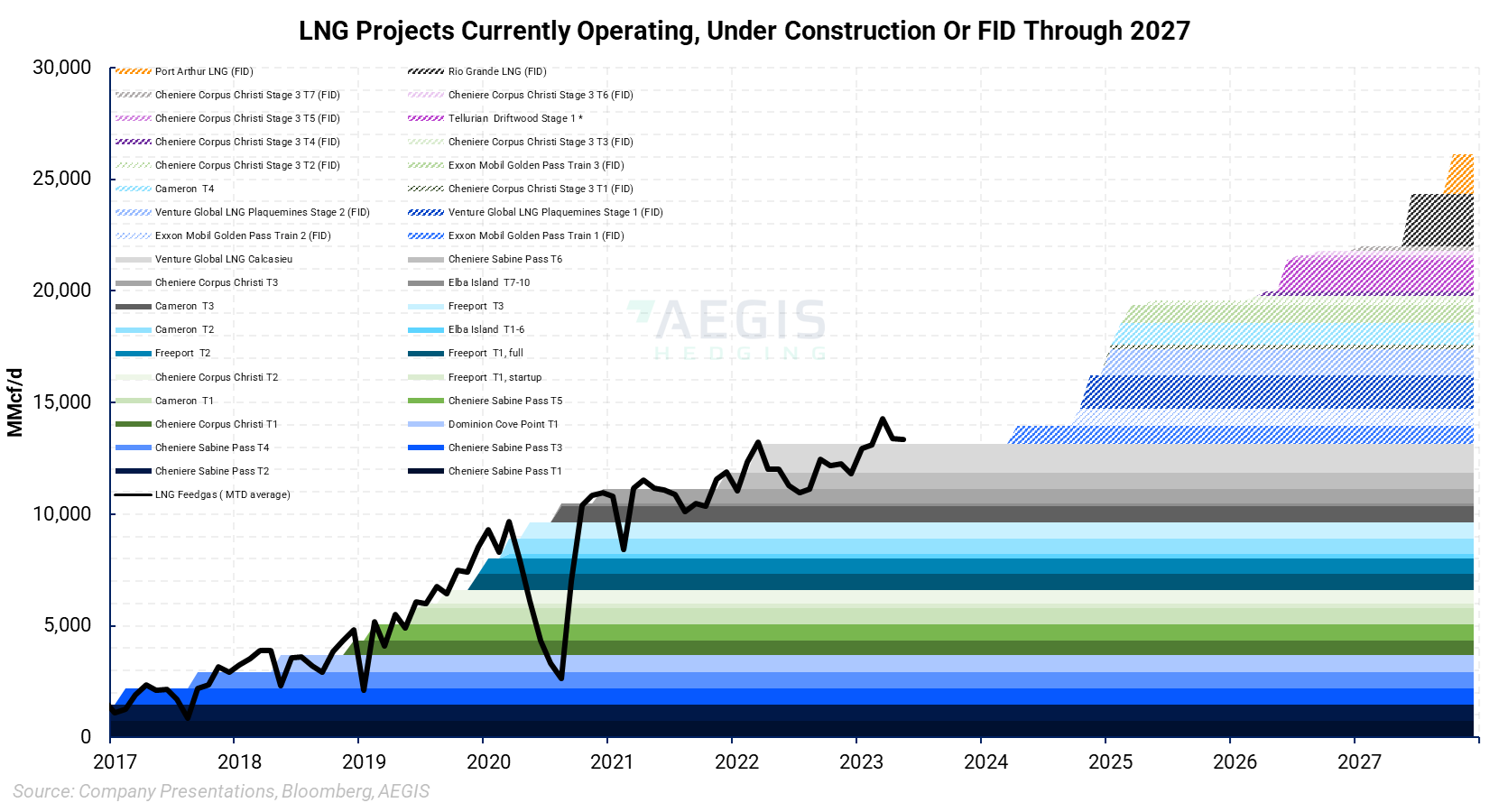

The US currently has 14 Bcf/d of peak LNG export capacity in operation, an additional 11.2 Bcf/d under construction or with limited construction already commenced (Corpus Christi Stage III, Golden Pass, Port Arthur, Plaquemines, Port Arthur, and Rio Grande).

With Europe expected to require large LNG volumes for years to come, the US is positioning itself as a reliable long-term supplier. But the outlook depends on the timely execution of the proposed capacity, especially as other exporters like Qatar also announce major expansion plans.

|

|

|

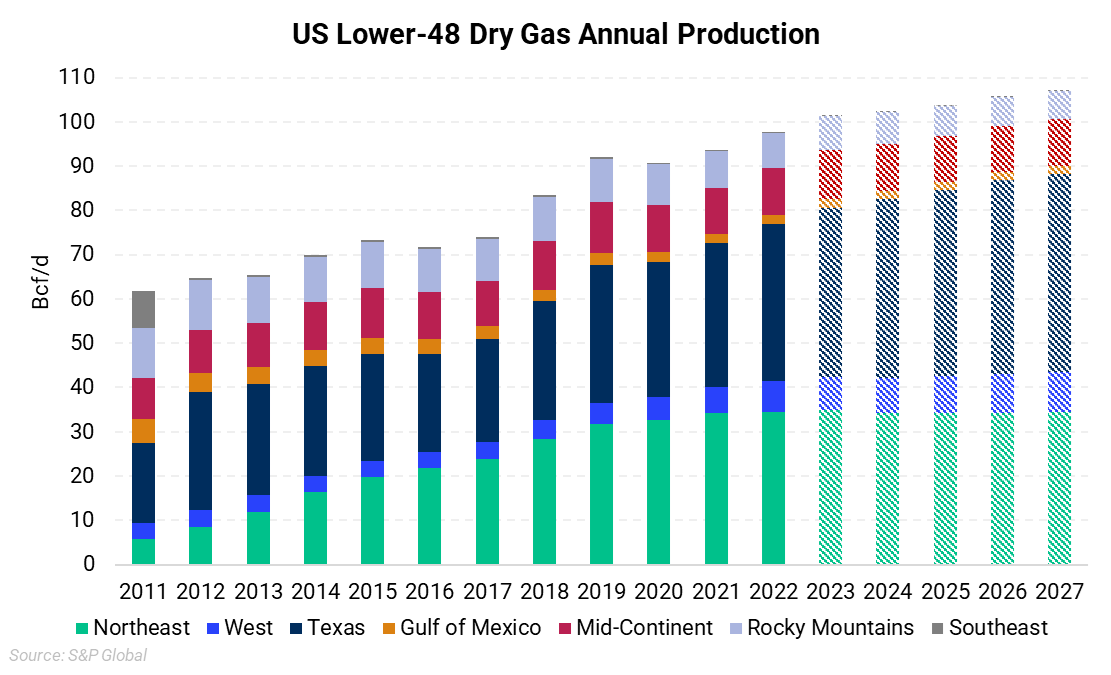

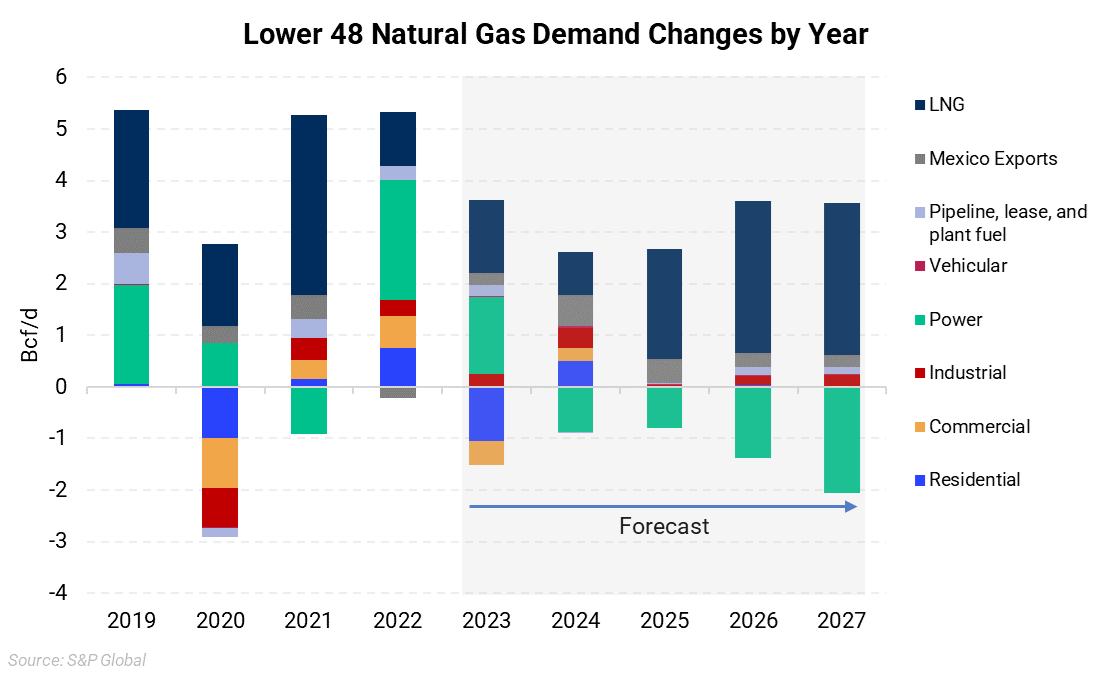

As the chart on the top right shows, the majority of natural gas demand for 2024-2027 is led by LNG export growth. US Lower 48 natural gas demand is projected to grow through 2027, with total demand, including exports, reaching 109.7 Bcf/d in 2025. This is 5.7 Bcf/d higher than in 2022, primarily driven by high expectations for LNG feed gas, which offsets declines from power, residential, and commercial demand. With new LNG export capacity anticipated to start coming online in late 2024, production is expected to increase through 2027. Given the infrastructure limitations in Appalachia, Haynesville is projected to be the main production source to meet the resurging LNG demand, driven by an additional 4.3 Bcf/d of LNG export capacity expected between 2023 and 2025. |

|

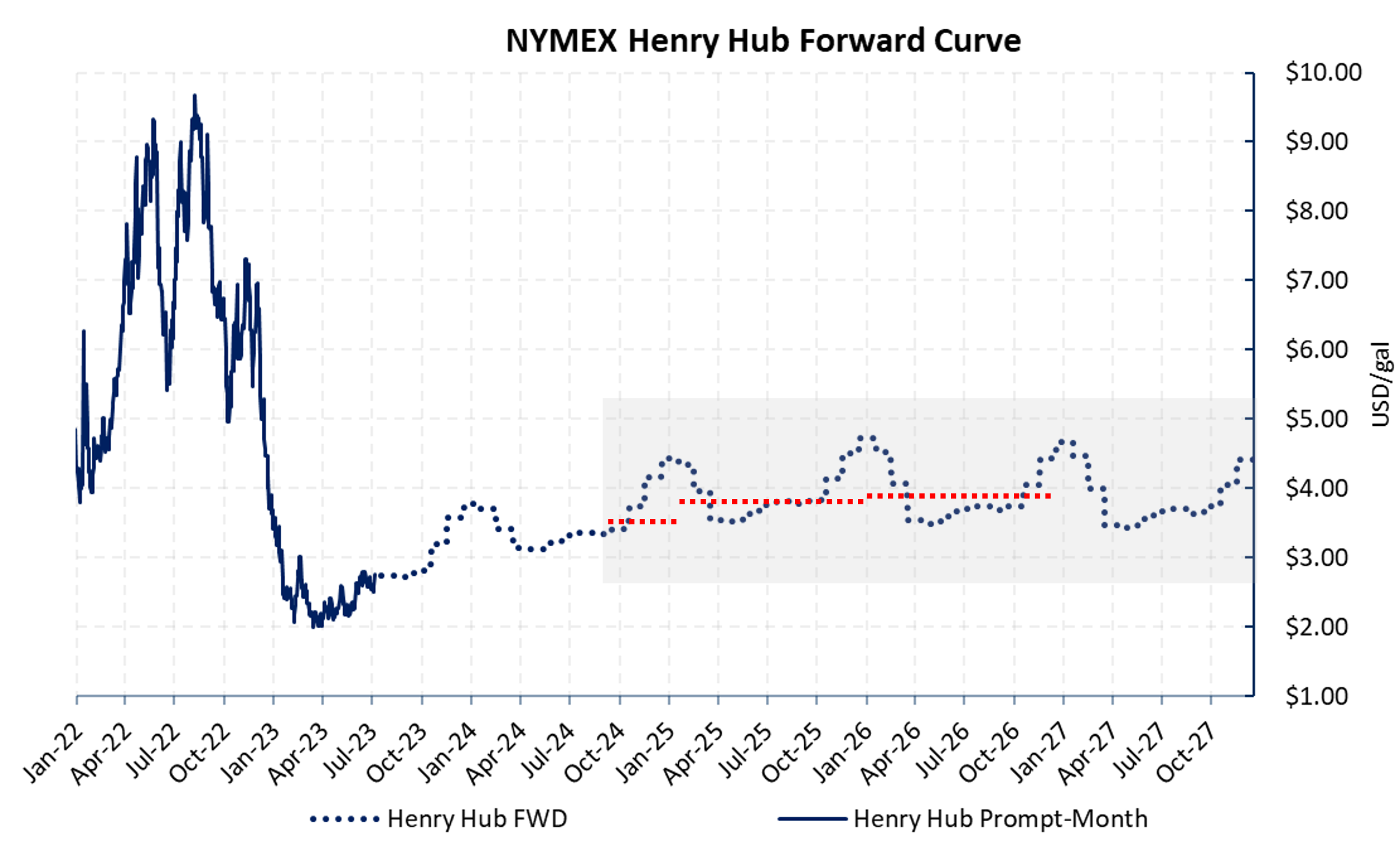

AEGIS is constructively bullish on natural gas prices from the second half of 2024 due to new LNG facilities coming online; there's considerable potential for more upside. The demand surge from 2H 2024 to 2026 will necessitate significant supply growth to meet export demand, further supporting price escalation. |

|

Upcoming Projects

The Golden Pass Trains 1 and 2 are being constructed at an existing LNG import terminal in Texas, which will be converted into an LNG export facility. The project consists of three trains. Each train has a peak capacity of 0.80 Bcf/d. According to FERC, Trains 1 and 2 are expected to be operational in 2Q and 4Q of 2024, respectively. Train 3 is planned to be online in 1Q2025.

The Plaquemines LNG Phase 1 project, located in Louisiana, is a Venture Global project. Phase 1 includes nine blocks, each containing two liquefaction trains, totaling 18 liquefaction trains. These have a peak capacity of 1.6 Bcf/d. According to FERC filings, developers plan to bring Phase 1 online by the end of 2024, with LNG production expected to start in August 2024.

The Golden Pass Trains 1 and 2 and Plaquemines Phase 1 are estimated to add a total of 2.7 Bcf/d of nominal LNG export capacity or 3.2 Bcf/d of peak capacity. By the end of 2024, U.S. LNG nominal liquefaction capacity is expected to increase to 17 Bcf/d across the nine U.S. LNG export facilities.

Apart from Golden Pass and Plaquemines, other new LNG export facilities expected to begin commercial operations by the end of 2027 include Corpus Christi LNG Stage III, Cameron T4, Rio Grande LNG, Tellurian’s Driftwood LNG, and Port Arthur LNG.

Exports of US LNG

As the world's largest producer of natural gas and the second-largest exporter of LNG, the US is seeing a surge in the construction of new LNG export facilities. This trend is projected to persist in the foreseeable future, reshaping the landscape of U.S. natural gas demand.

The increased exports of LNG could reduce the amount of natural gas available for domestic consumption. Such a scenario could lead to higher US natural gas prices and lower demand for natural gas in some sectors, such as power generation.

In the first half of 2023, pipeline deliveries of natural gas to US LNG export facilities averaged 12.8 Bcf/d, an 8% increase from the 2022 annual average, according to the EIA. A record 14 Bcf/d of LNG feed gas was set in April 2023, largely due to the absence of outages or maintenance at any of the facilities. However, due to maintenance at facilities like Sabine Pass and Cameron, feedgas levels declined to 13 Bcf/d in May and 11.5 Bcf/d in June 2023.

LNG feedgas levels are typically higher than export levels as some feed gas is used to operate on-site liquefaction equipment. Except for Freeport LNG, all US LNG export facilities have on-site natural gas-fired power plants for this purpose. The EIA estimates that about 14% of LNG feed gas is used for liquefaction processes, mainly for on-site power generation.

The US significantly expanded its LNG exports in 2022, cementing its position as a top global supplier. According to the International Gas Union's World LNG Report 2023, the US exported approximately 3.81 Tcf of LNG last year, a 15% increase over 2021 volumes of about 3.32 Tcf.

This added around 396 Bcf of supply to the total global LNG trade, which reached approximately 15.11 Tcf in 2022. The growth was enabled by new liquefaction trains coming online, including Train 6 at Cheniere's Sabine Pass facility and Venture Global’s Calcasieu Pass.

Growth Aided by Russia-Ukraine Conflict

The outbreak of the Russia-Ukraine conflict in February 2022 sparked an unprecedented surge in LNG demand from Europe as countries urgently sought to replace Russian piped gas imports.

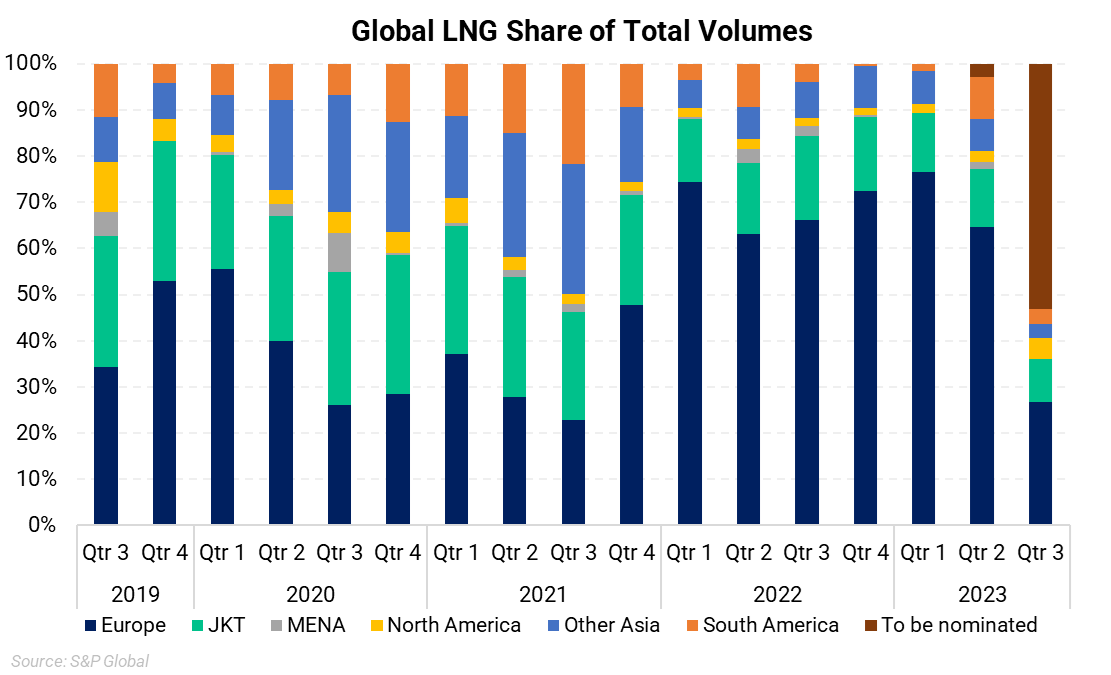

Reduced flows from Russia, Europe's largest gas supplier, left the continent with a 70% supply deficit by end-2022. Europe's LNG imports skyrocketed by about 1.9 Tcf in 2022, reaching approximately 4.76 Tcf in total. The chart in the bottom left shows the market share of total LNG volumes exported by the US. Europe imported 2.71 Tcf of US LNG in 2022, up by 119.6% from 2021’s levels.

|

|

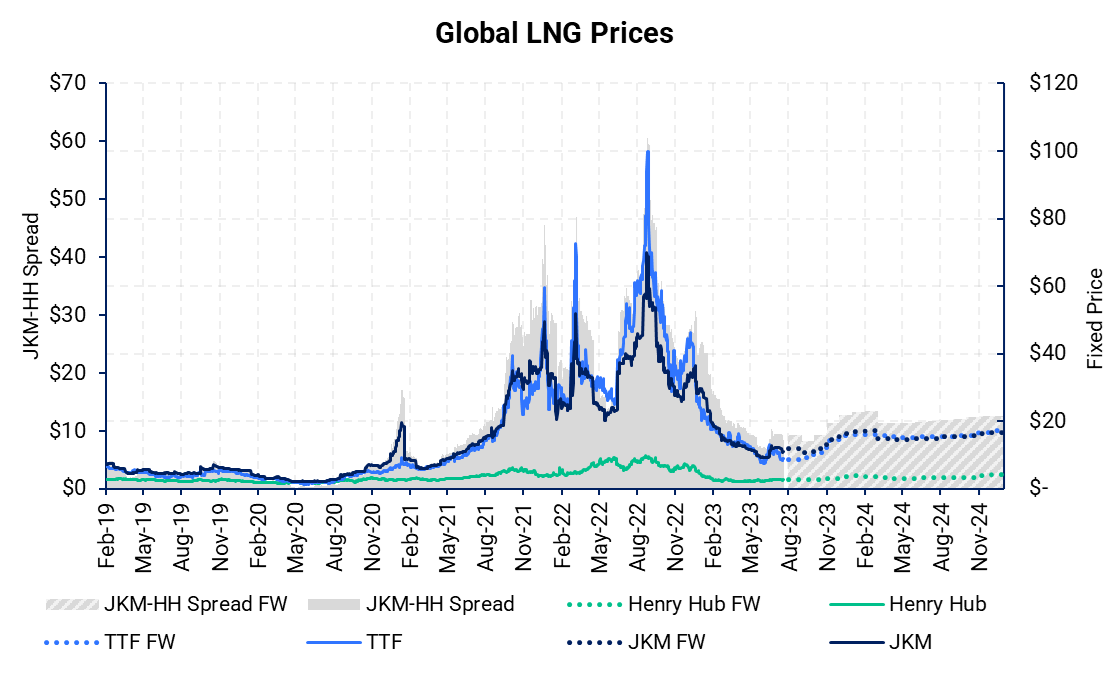

In the aftermath of the invasion, LNG prices soared to record highs. The Platts JKM and TTF prompt for LNG delivered to Northeast Asia and Europe peaked at $69.95/MMBtu and $99.74/MMBtu, respectively, in August 2022, the highest ever recorded.

Since the initial spike in prices, LNG prices have come down. However, they remain elevated compared to pre-war levels, as the chart on the top right shows. The Platts JKM and TTF futures are currently trading around $8.86/MMBtu and $10.75/MMBtu in July 2023, which is still significantly higher than the price of natural gas in the US, which should incentivize mid-streamers to continue high LNG exports.