Rising tensions between the United States and Iran have become the dominant driver of crude markets, pushing WTI prices above $66/Bbl and lifting oil to the highest levels since late September. The latest escalation in rhetoric and military posturing has revived fears of supply disruptions in the Middle East, injecting a geopolitical risk premium into prices despite an otherwise bearish structural outlook.

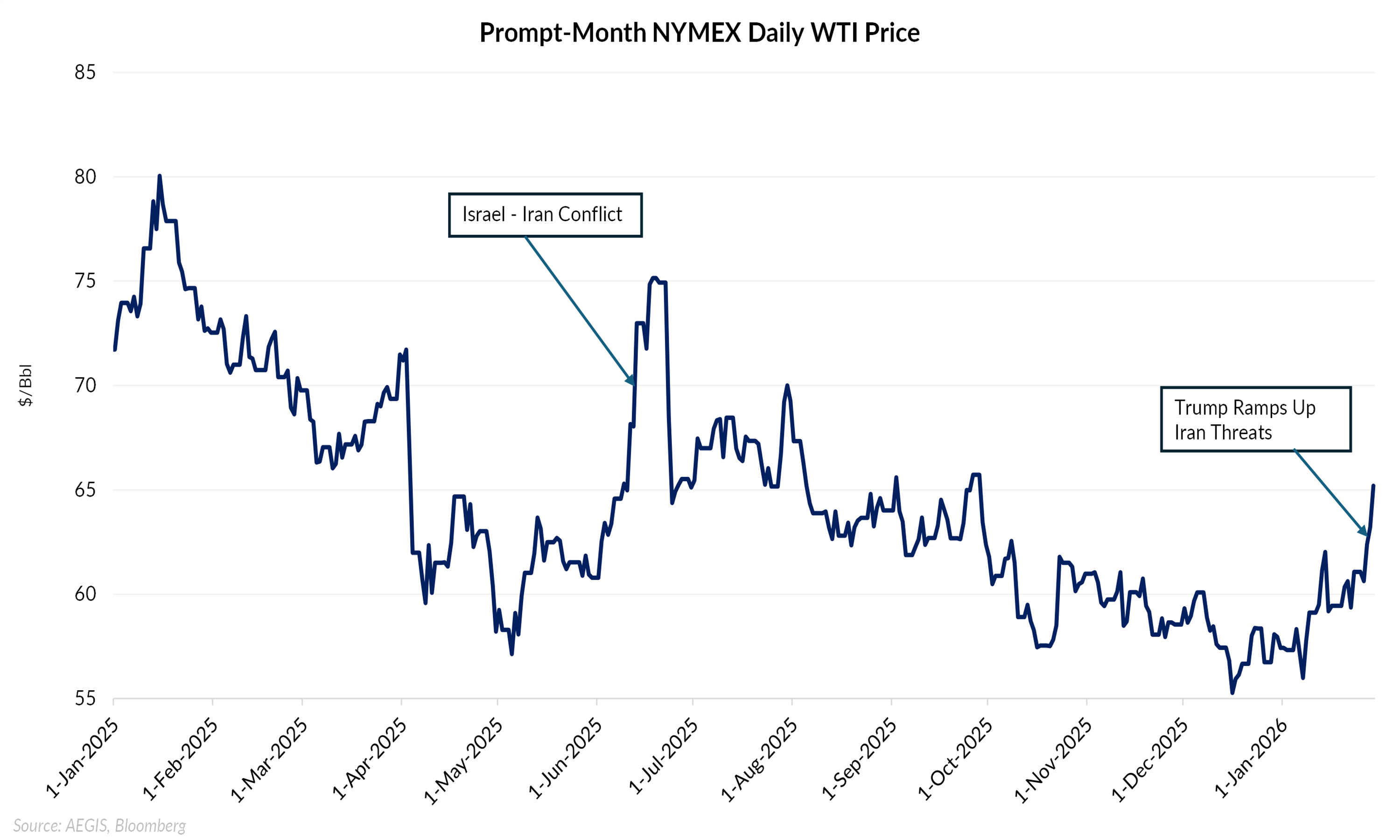

Oil markets have reacted sharply to the prospect of US military action and potential Iranian retaliation. Recent reports indicate that Washington is weighing targeted strikes, while Tehran has threatened countermeasures, raising concerns about disruptions to crude flows from the Gulf. As a result, WTI climbed to a four-month high, with markets increasingly pricing a geopolitical risk premium into the front end of the curve. Citigroup estimates that the geopolitical risk could add roughly $7–10/Bbl to Brent prices, underscoring the scale of risk currently embedded in global crude markets. As shown in the chart below, episodes of heightened geopolitical tension have repeatedly coincided with sharp rallies in prompt-month WTI prices. The most notable example occurred last year following Israel’s strikes on Iran, when fears of retaliation and wider regional escalation drove a rapid repricing of near-term crude risk, despite limited immediate disruption to physical supply.

The market’s sensitivity stems less from Iran’s standalone production, currently just over 3 MMBbl/d, and more from its strategic position within global energy flows. Any escalation involving Iran raises the risk of disruptions to the Strait of Hormuz, a critical chokepoint through which roughly 20 MMBbl/d of oil transit, accounting for about 30% of global trade. Saudi Arabia, the UAE, and Iraq all depend heavily on this corridor for exports, amplifying the potential market impact of even limited conflict.

Source: Encyclopaedia Britannica

Beyond oil, the implications extend to global gas markets. Qatar and the UAE together account for a significant share of global LNG exports, meaning heightened geopolitical risk in the Gulf has the potential to influence both crude and natural gas pricing dynamics. More broadly, current price levels reflect not only physical supply conditions but also a geopolitical risk premium tied to potential disruptions to Gulf shipping routes, rather than actual interruptions in physical crude flows. Any move toward US–Iran diplomatic engagement or broader regional de-escalation could quickly compress this risk premium and shift market focus back toward underlying supply–demand fundamentals.