Oil and gas operators across Texas, northern Louisiana, and southern New Mexico ended 2025 on a cautious footing as activity remained in contraction and confidence failed to improve meaningfully. The latest Energy Survey from the Federal Reserve Bank of Dallas suggests the industry has stabilized at a lower level of activity but continues to operate defensively heading into 2026.

Business Activity Remains Stuck Below Zero

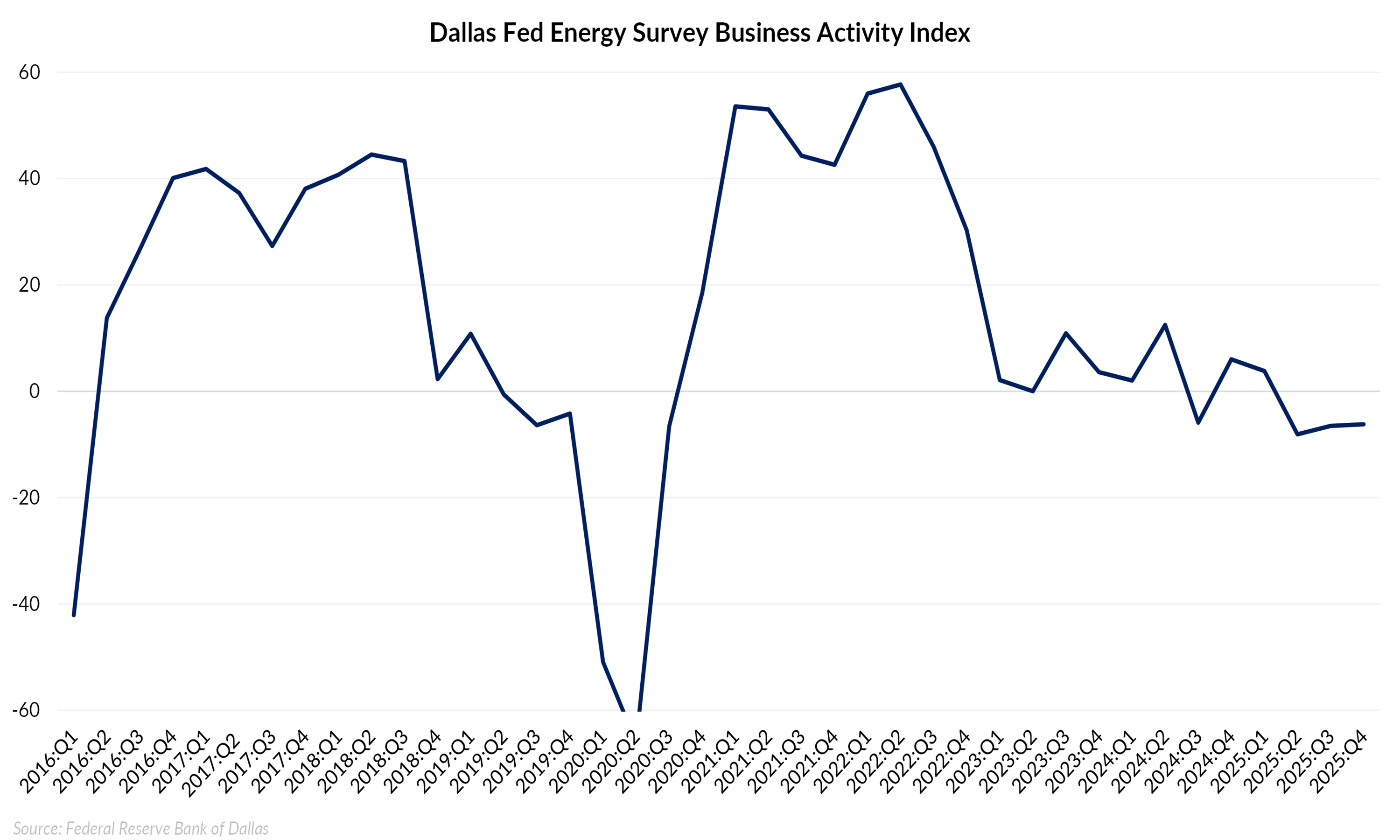

The Dallas Fed’s business activity index held at -6.2 in the fourth quarter, extending a period of contraction that began earlier in the year. This follows only a modest improvement in the third quarter, when the index rose to -6.5 from -8.1 in the second quarter, underscoring that conditions have steadied but not recovered. Because the index measures the net share of firms reporting increases versus decreases in activity, a negative reading indicates that declines continue to outnumber gains.

The persistence of sub-zero readings points to an industry in a holding pattern. Activity is no longer deteriorating rapidly, but it has yet to show signs of renewed momentum. Firms appear to be maintaining production and operations while delaying expansion until the outlook improves.

Capital Spending Reflects Caution, Not Conviction

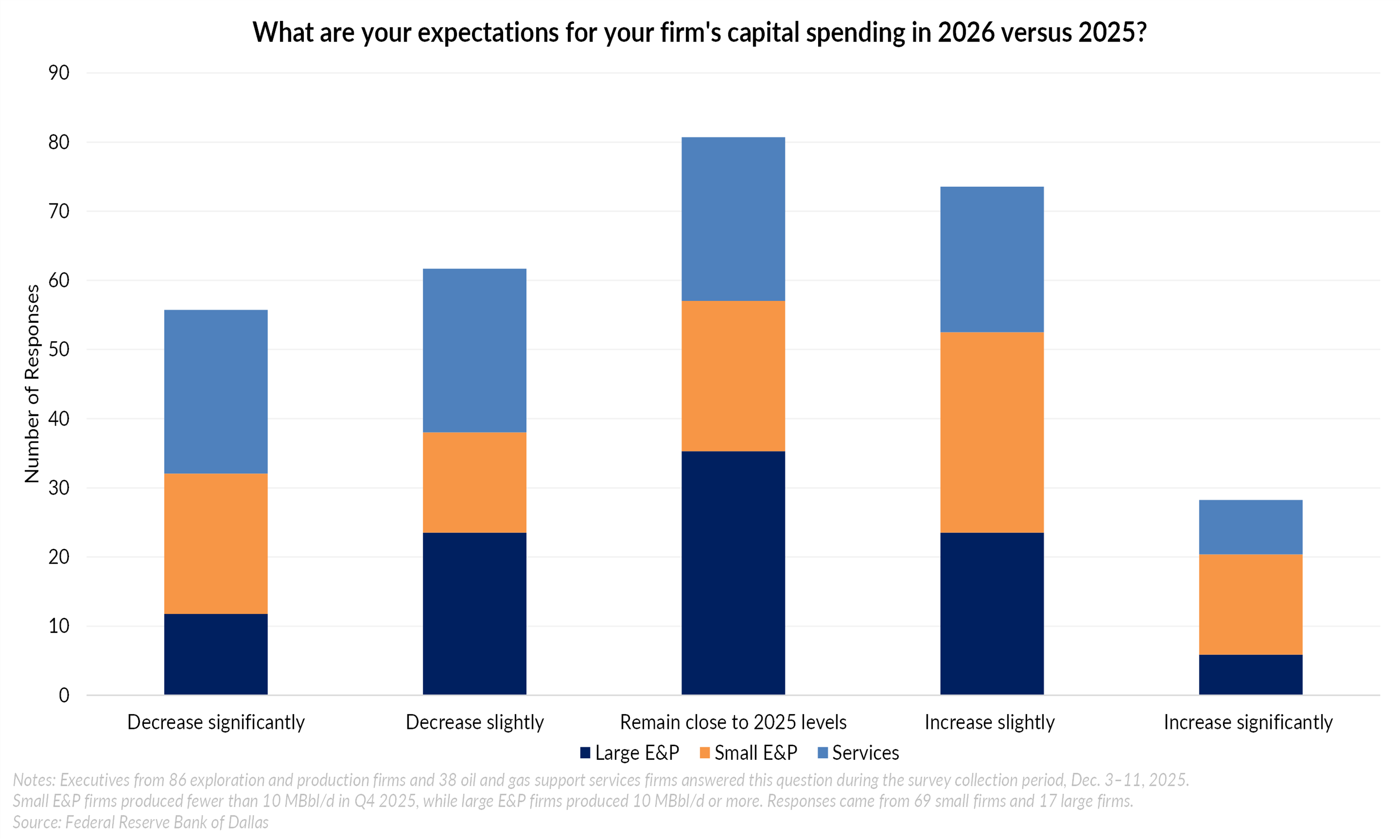

This restraint is most clearly reflected in firms’ capital spending expectations for 2026. Responses were widely dispersed but skewed cautious. Nearly 40% of executives expect capital spending to decline relative to 2025, while 24% expect spending to remain near current levels. Although 37% anticipate some increase, most of those gains are expected to be modest rather than transformative.

The breakdown by firm type reinforces this defensive posture. Large exploration and production firms most commonly expect capital spending to remain flat, signaling a focus on capital preservation. Small E&P firms were somewhat more inclined to expect slight increases, reflecting greater sensitivity to marginal improvements in economics. Oilfield services firms, however, stood out as the most pessimistic, with nearly half expecting spending declines, consistent with ongoing margin pressure and weak pricing power.

Taken together, these responses suggest firms are positioning conservatively, prioritizing flexibility over growth.

WTI Expectations Hold Near $60 with Planning Assumptions Turning Conservative

Respondents expect WTI crude to average roughly $62 per barrel by year-end 2026, with higher prices anticipated over longer horizons. These expectations point to some confidence in longer-term fundamentals.

However, capital planning tells a different story. Firms reported using an average WTI price of $59 per barrel to plan 2026 spending, well below the $68 used in 2025 budgets. This reset highlights a deliberate shift toward conservative assumptions, emphasizing downside protection over upside participation. In effect, firms may expect prices to improve, but they are unwilling to base investment decisions on that outlook.

Conclusion: Stability Without Confidence

Overall, the fourth-quarter survey depicts an industry that has stabilized but remains constrained by caution. Activity has stopped worsening, capital spending plans remain restrained, and planning assumptions have become more conservative. Compared with earlier quarters, the narrative has not changed materially, but it has hardened. For now, capital discipline, not growth, continues to define the sector’s strategy heading into 2026.