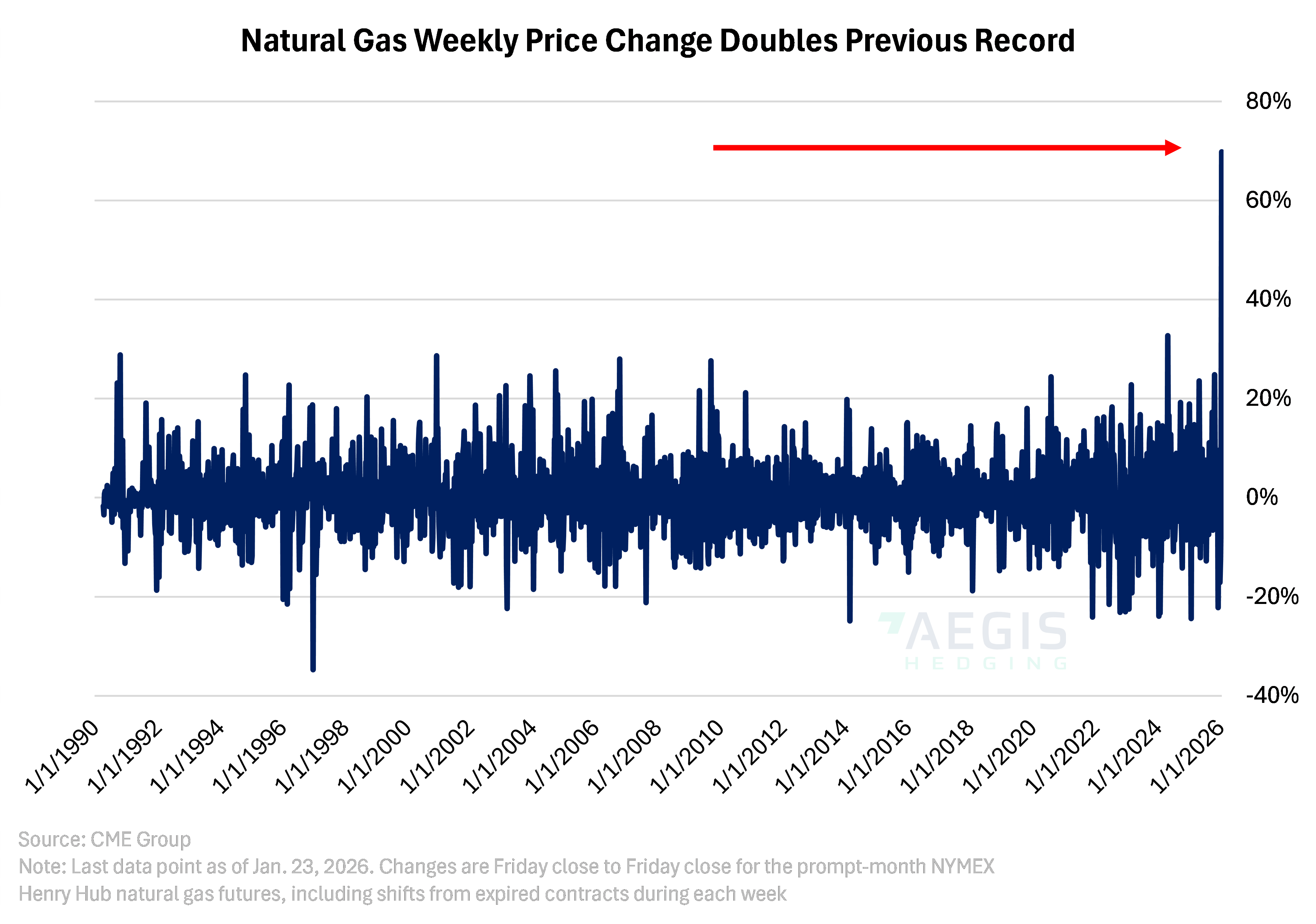

After the Henry Hub natural gas price for February doubled, oil-and-gas producers aggressively locked in hedges. Cold weather caused the largest one-week rally since at least 1990.

Oil and gas producers leaned into the historic rally in Nymex Henry Hub prices driven by Winter Storm Fern. The storm brought sub-freezing temperatures across much of the Lower 48, tightening balances and sending natural gas prices sharply higher in a ten-day period from January 19 to January 28.

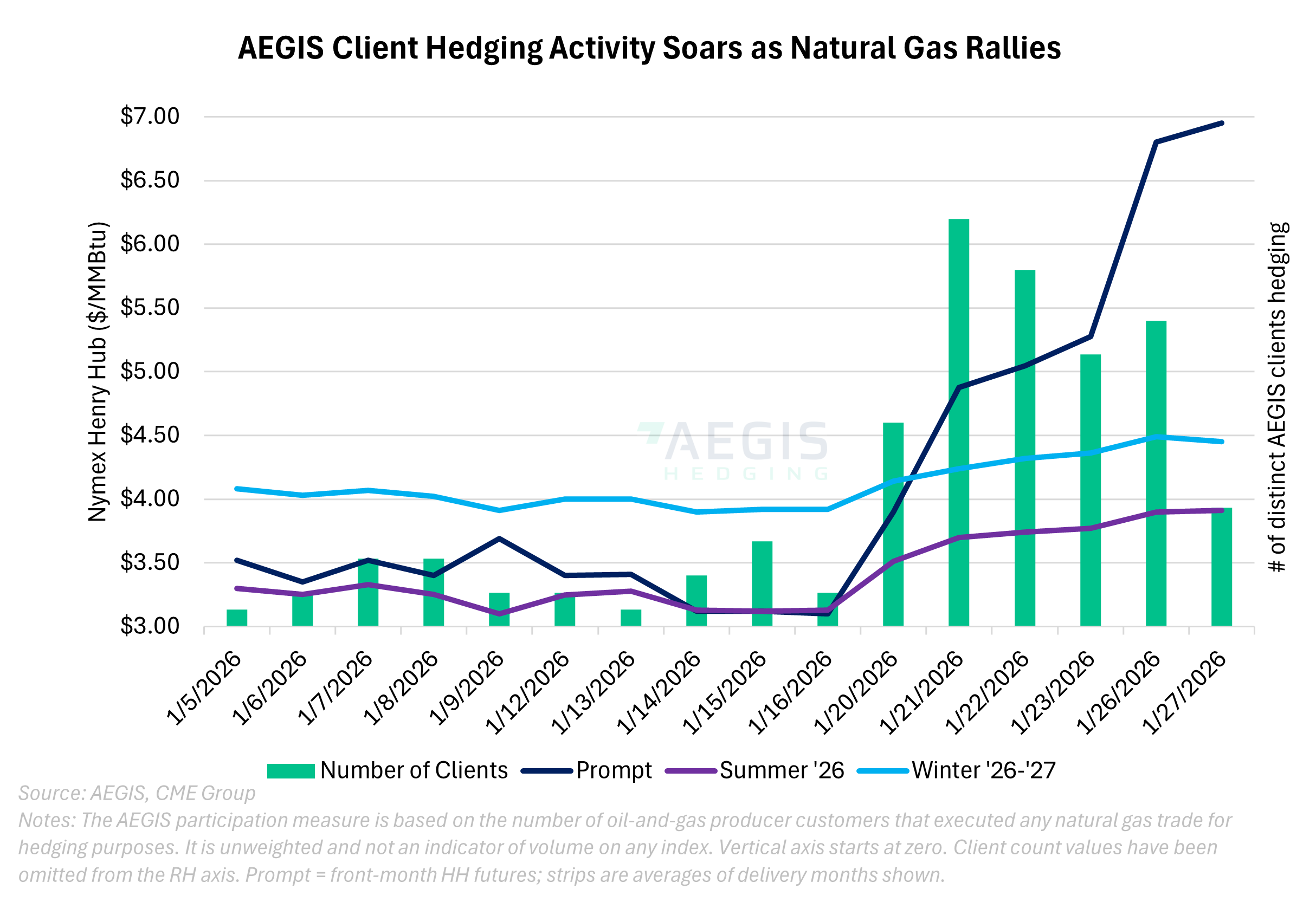

AEGIS client hedging activity for natural gas reached the most active levels on record during the week ending January 23 and continued at elevated levels into the following week. Activity is measured by the number of distinct clients hedging, which serves as a gauge of broad industry participation rather than total hedged volume. Our trading desk described the surge in activity during and leading up to the storm: “The trade team was working through one of the heaviest workloads in our firm’s history as natural gas was going parabolic,” said Karen Kearby, Director of Trading at AEGIS Hedging.

The AEGIS sample above shows a 6x increase in hedging participation during Winter Storm Fern.

The chart above shows how hedging activity accelerated as the Henry Hub forward curve strengthened. The Summer ’26 strip (April–October) had traded in a relatively narrow range between $3.10 and $3.33/MMBtu for most of January before the winter storm shifted market sentiment and lifted prices. The following seasonal strip, Winter ’26–’27 (November–March), also moved materially higher — climbing from around $4.00 to $4.50/MMBtu by Monday, January 26.

While the sharp move in the prompt month (February) captured most of the headlines, producers typically hedge further out on the curve when managing price risk. The strength in 2026 and Winter ’26–’27 pricing provided an opportunity for many operators to secure improved cash flow visibility and protect drilling economics.

AEGIS manages a significant share of U.S. oil and gas hedging activity as the largest independent hedging advisory firm in the country, providing a unique view into how producers respond to major shifts in the forward curve. The recent surge in participation highlights how quickly commercial hedgers move to de-risk when volatility creates attractive pricing windows.

Disclaimer

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. To learn more, visit www.aegis-hedging.com. |