THE WOODLANDS, TX — AEGIS Hedging Solutions, the leading fintech and advisory solutions provider for commodity and rate hedging, was recently recognized as the 2020 Hedging Advisory Firm of the Year by Energy Risk Magazine. This marks the fourth consecutive year AEGIS has been recognized for excellence across global commodity and rate markets.

This past year has presented several challenges for the oil and gas industry. AEGIS' 200 energy-producing clients were not immune; however, each were able to utilize AEGIS' market analytics, hedge strategy and execution, and technology to navigate massive market volatility. "There has never been a better case study for the impact of tail risk and the need to continually hedge commodity price exposures," said Bryan Sansbury, Chief Executive Officer of AEGIS.

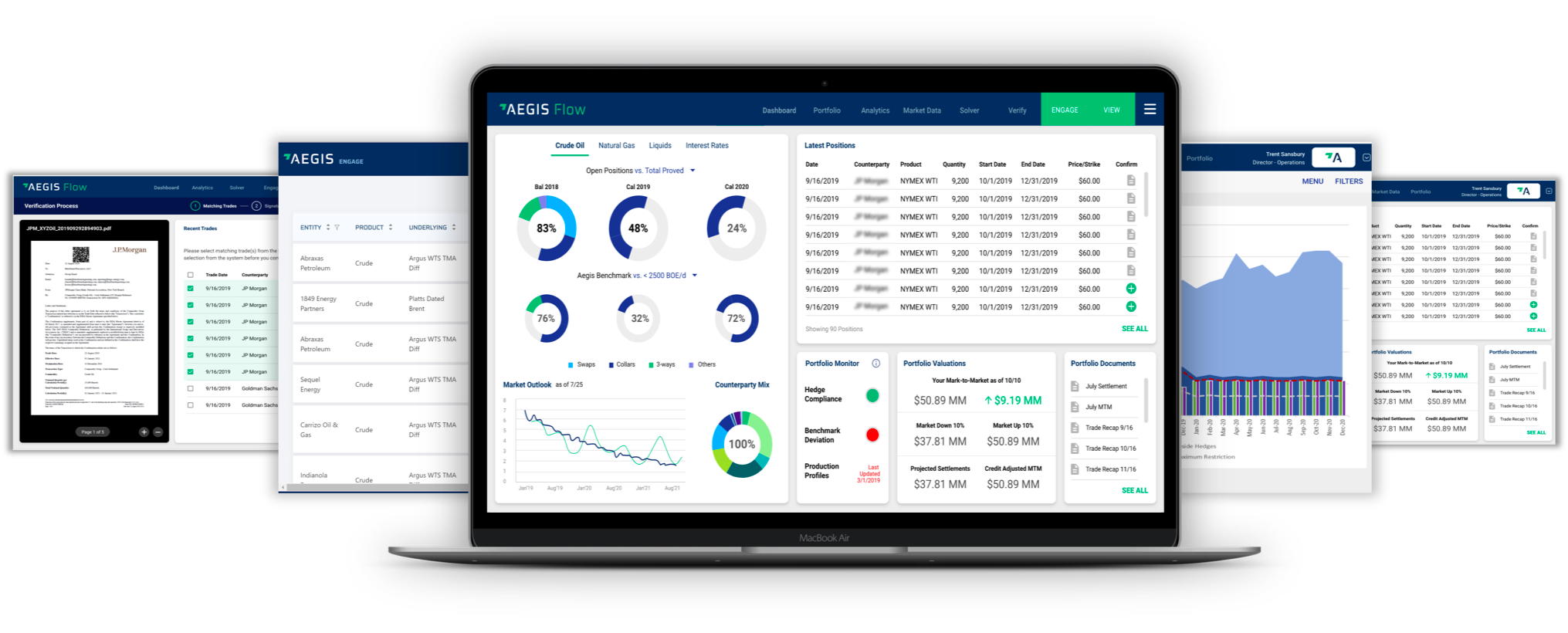

On September 14, 2019, key Saudi Arabian oil facilities were attacked, causing crude prices to spike briefly. AEGIS was able to work with each of its clients, utilizing its Flow technology, to quickly assess exposures and available hedge capacity. AEGIS had its full trading staff in the office on Sunday night to trade the Asian markets, ensuring clients would benefit from the short-lived higher prices.

"AEGIS' ability to identify and act during this short window of opportunity was crucial for our clients," said Chris Croom, President of AEGIS. "We are always watching the markets for opportunities to further de-risk, and we made sure our clients saw the same sense of urgency," he says. "It's hard to know how long a specific opportunity like this one will last, but the hedges we placed that Sunday evening became critical to navigating the recent crude price meltdown."

This last Spring, facing crude oil prices that dipped below $0, AEGIS and its clients navigated the price action with relative calm, knowing the hedge program was designed to protect against this exact scenario. While no producer likes to see prices at such low levels, producers were able to utilize the Flow platform to quickly review their hedge books with AEGIS from one screen, consider production areas, and engage in thoughtful discussions on crystallizing hedges, paying down debt, and shutting in production.

Each year, AEGIS has continued to work with clients to shape capabilities around proactively understanding the market, tailoring hedge strategies to client-specific situations, and taking meaningful action through people and technology. Said another way, AEGIS is modernizing hedging interactions with clients and counterparties, bringing significant cost and operational efficiencies.

"We see the need for transformation in this space, and we're making significant investments to lead it through our technology and human intelligence. We have established ourselves as the leading fintech and advisory solutions provider and our business has grown significantly despite these trying times. While we are excited about the progress we have made, we are still just getting started," said Patrick McCrann, Director of Business Development of AEGIS.

About AEGIS Hedging Solutions

AEGIS Hedging Solutions is the recognized global leader for hedging technology and expertise. AEGIS' proprietary technology platform and unmatched experience in the commodity and rate hedging markets combine to help producers, consumers, manufacturers, and investors protect their cash flow. For more information, please visit www.aegis-hedging.com.