The Trump administration has introduced a series of tariffs with significant implications for the global energy market. These measures, part of a broader strategy to address trade imbalances and geopolitical tensions, have directly targeted energy imports and related sectors, prompting retaliatory responses from major trade partners.

Below is an overview of the key energy-related tariffs currently in place or scheduled for implementation:

Canada

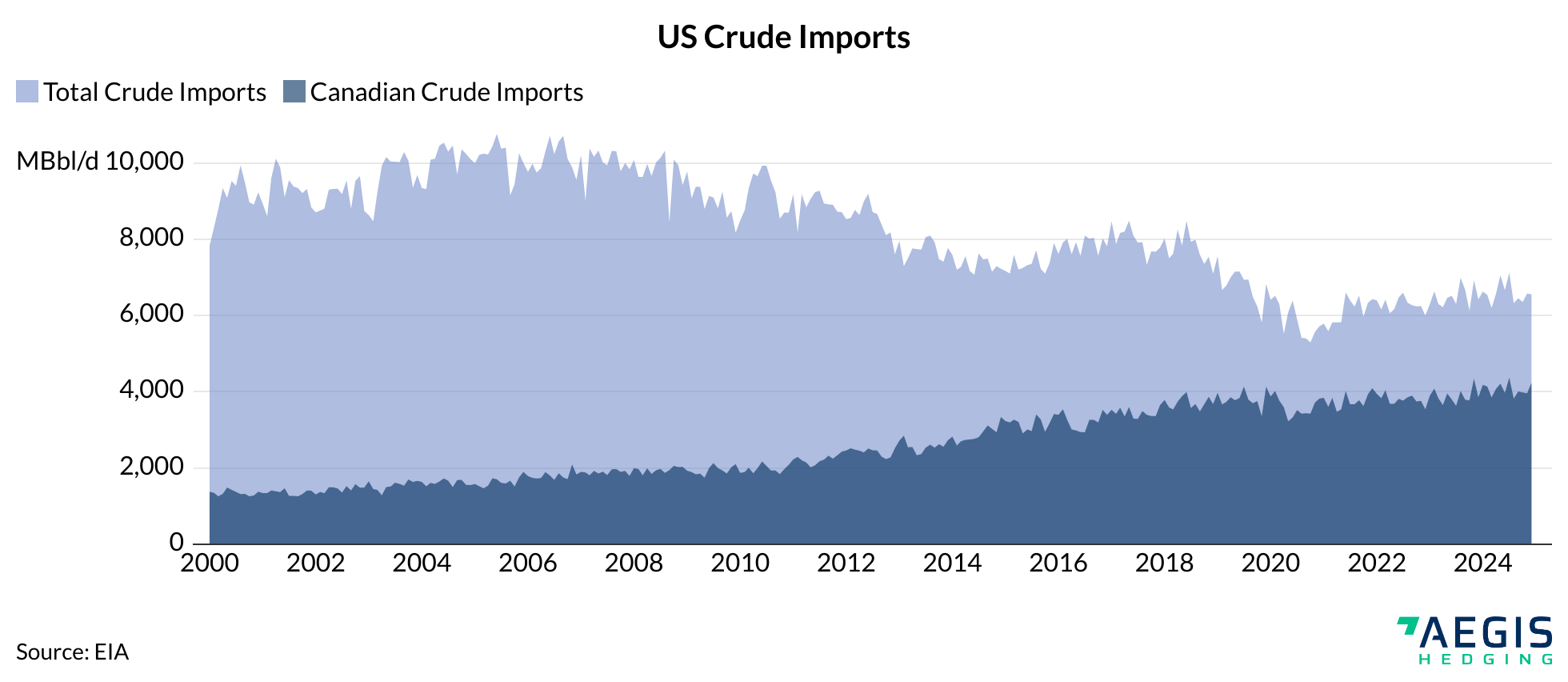

Canada is a pivotal energy trade partner for the US, supplying approximately 62% of total US crude oil imports. In the first ten months of 2024, Canada exported an average of 4.2 MMBbl/d to the US, with the majority directed to refineries in PADD 2 (Midwest). Additionally, about 80% of Canada's crude production and 40% of its natural gas production are sold to the US.

To mitigate the impact of these tariffs, Canadian exporters may explore alternatives such as increasing shipments via the Trans Mountain Expansion (TMX) pipeline to the West Coast or increasing volumes delivered to US Gulf Coast export terminals via cross-border pipelines. Nonetheless, the US is expected to remain the primary market for Canada's oil exports in the near term.

In the natural gas sector, the US currently serves as Canada's sole export market, a situation that will persist until LNG Canada commences operations, with its first shipment anticipated in mid-2025.

Mexico

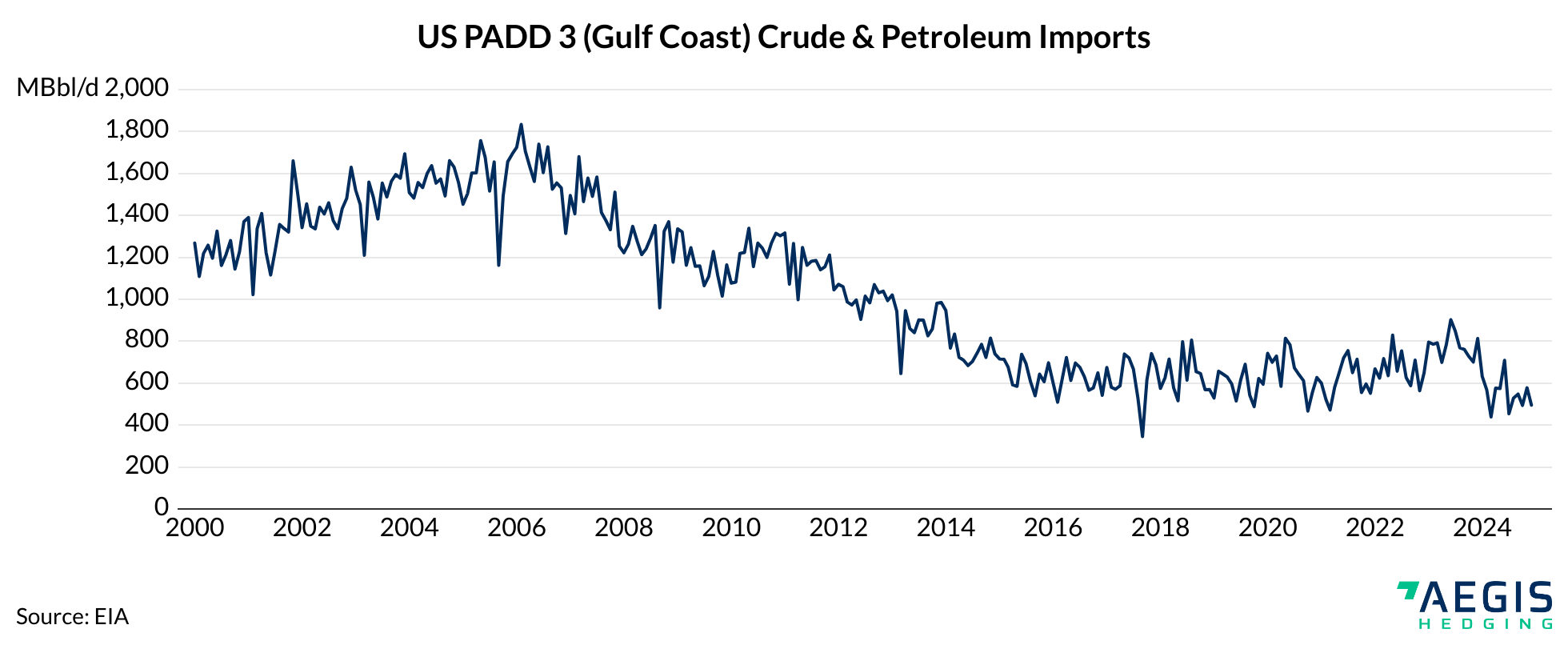

Mexico plays a crucial role in the North American energy landscape, both as a supplier of crude oil to the US and as a consumer of US refined products. In 2024, the US imported approximately 625 MBbl/d of crude and petroleum products from Mexico, primarily heavy Maya crude destined for PADD 3 (Gulf Coast) refineries. These refineries are optimized to process heavy crude, making Mexican imports particularly valuable. Conversely, Mexico relies heavily on the US for gasoline and diesel imports due to its limited refining capacity.

The imposition of tariffs may prompt Mexico to seek alternative markets for its crude oil exports, potentially turning to Asian and European buyers. However, logistical challenges and existing trade relationships may limit the feasibility of such diversification in the short term.

China

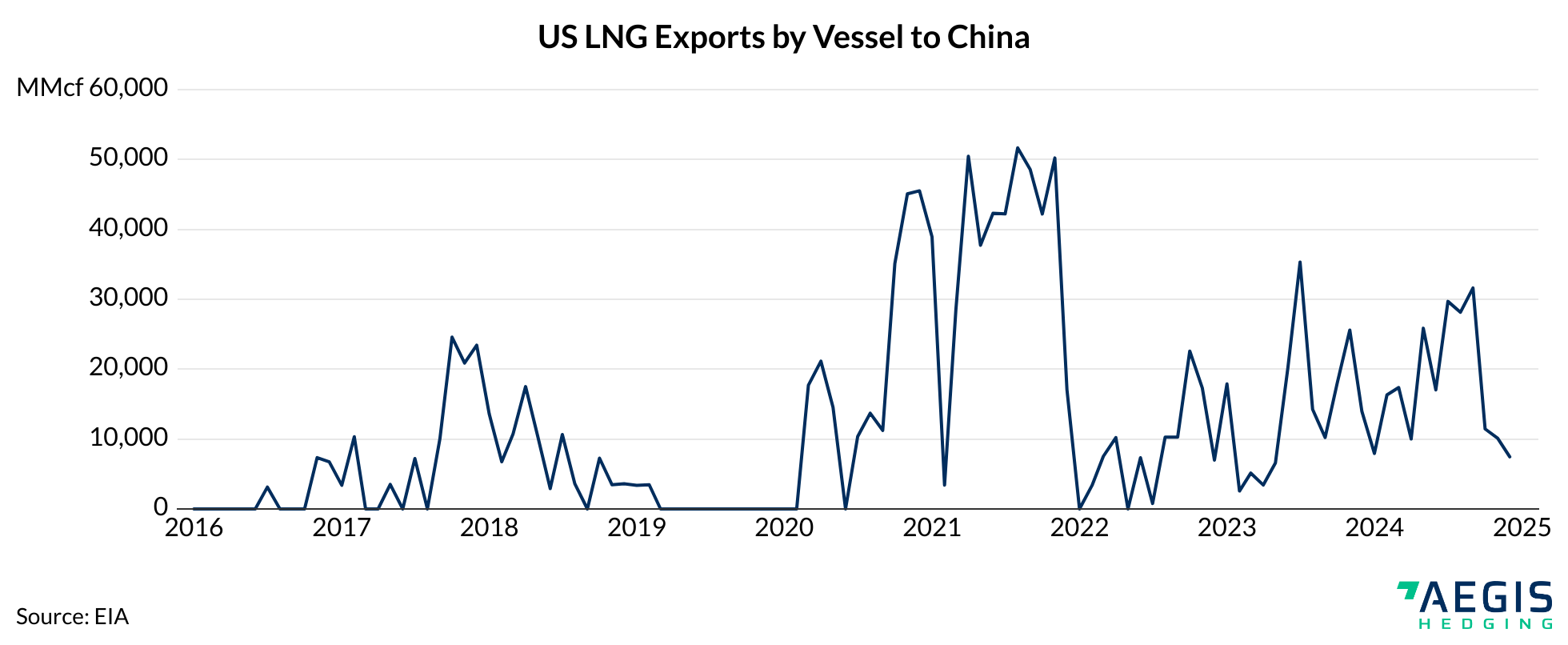

While energy trade between the US and China represents a smaller portion compared to other partners, US LNG and crude exports to China have increased in recent years.

China, as the world's second-largest economy, plays a pivotal role in global energy demand. The imposition of tariffs and the ensuing trade tensions have the potential to dampen economic growth, thereby reducing global energy consumption.

Steel & Aluminum

Canada, as the largest exporter of steel to the US, faces significant exposure to these tariffs, supplying approximately 6.56 MM tons annually. Although not solely categorized as energy tariffs, these measures have profound implications for the oil and gas industry.

Steel and aluminum are critical materials for constructing pipelines, drilling equipment, and refineries. The increased costs associated with these tariffs are likely to elevate infrastructure expenses, potentially impacting project viability and timelines within the energy sector.

Venezuelan "Secondary" Tariff

This unprecedented measure primarily targets nations like China and India, which have been significant importers of Venezuelan crude. In 2024, Venezuela exported approximately 660 MBbl/d, with China being the largest importer at an estimated 270 MBbl/d, according to Kpler data. India also remains a key buyer.

Additionally, US Gulf Coast refineries have historically relied on Venezuelan heavy crude, ranking third behind Canada and Mexico in 2024. Imports into PADD 3 (Gulf Coast) averaged 211 MBbl/d in 2024, reaching 285 MBbl/d in December, according to EIA data.

The implementation of these tariffs is expected to disrupt existing supply chains, compelling US refiners to seek alternative sources of heavy crude, potentially from Middle Eastern producers or increased domestic production.

Market Implications

The Trump administration’s energy tariffs are reshaping trade across North America and Asia, raising costs for US consumers and reducing competitiveness for producers abroad. Tariffs on steel and aluminum may further inflate infrastructure costs, impacting future investments. With rising trade tensions and growing market volatility, policymakers must weigh trade goals against risks to global energy stability.